Tax

New York state sues Sotheby's for allegedly helping collector evade tax on $27m of art

Auction house "vigorously refutes the unfounded allegations" made by the attorney general, who claims the auction house knowingly aided the offshore company Porsal Equities

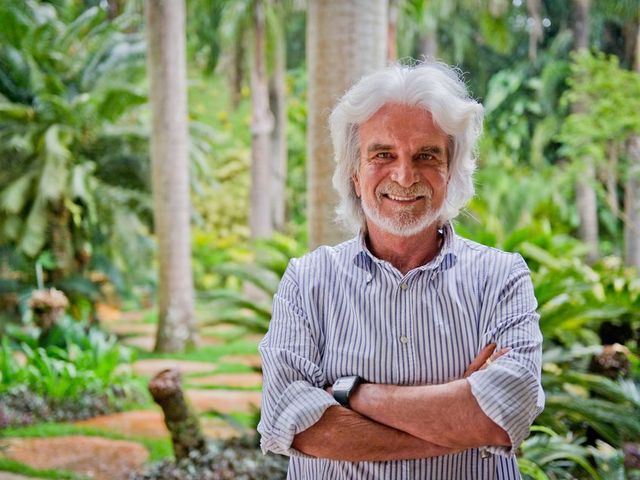

Inhotim cannot use works from its collection to pay off founder's debt, judge rules

The Brazilian arts park signed an agreement in 2016 to donate 20 works from its collection to the government in order to repay Bernardo Paz's $110m tax debt for laundering donations

Yves Bouvier evaded paying taxes on £276m of art sales, Swiss authorities claim

Switzerland's Federal Criminal Court ordered documents unsealed that call into question whether the dealer declared all profits from sales made to Dimitry Rybolovlev

US coronavirus legislation could do more for the arts, Boston museums say

The coalition is asking for $6bn in federal aid, and to permanently expand the charitable giving deduction to encourage US taxpayers to donate to non-profits

Christie's settles $16.7m in tax claims with New York District Attorney

Manhattan prosecutors say the auction house failed to collect sales tax on $189m in private sales over five years

Demand for New York's first freeport facility steps up

Increasing numbers of dealers and collectors take advantage of tax-exempt Arcis, the foreign trade zone in Harlem

Director of Pinault Collection proposes controversial 90% tax breaks for Notre Dame donors

But Pinault family says it is not seeking tax relief for its €100m donation towards the reconstruction effort

Jean-Claude Juncker dismisses claims that freeports are ‘systematically used to commit fraud’

European Commission president rebuffs German MEP Wolf Klinz's demand for a proper investigation into the management of Le Freeport Luxembourg

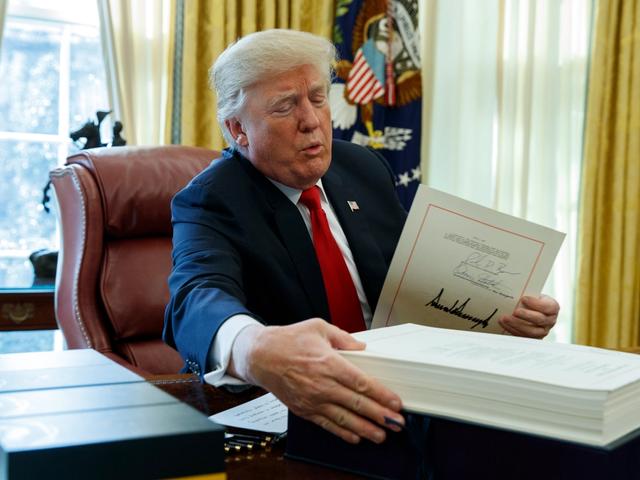

Trump’s tax Act offers potential tax havens for art

‘Opportunity Zones’ present a new kind of tax-deferred exchange on high-value assets

Rule of law: Legal tips for art lovers

From new exhibitor regulations at Art Basel in Miami Beach to questions over insurance and taxes

The tax man cometh: new laws on sales tax pose problems for US art dealers

US Supreme Court decision is causing anxiety among dealers

Dealer Mary Boone pleads guilty to $1.6m in tax fraud

The art dealer will pay $3m in restitution to the IRS after falsifying returns to hide her use of gallery profits to upgrade her Manhattan home

Guy Wildenstein cleared of tax evasion for a second time in Paris

Franco-American scion of art dealing dynasty was accused of hiding art and other property worth hundreds of millions of euros from French authorities

Art consultant pleads guilty to filing false tax return

Lacy Doyle hid millions of dollars in inheritance in a Swiss bank account, US Attorney says

How the new US tax law affects the art world

President Trump today signed sweeping changes to the tax system that will impact wealthy individuals, art businesses and museums

Will the US tax proposal sell out art buyers?

A proposed revision to the tax code could subject sellers to capital gains tax on art and slow the market

Public asked to photograph ‘secret collection’ of works stored in homes across the UK

Open Inheritance Art project aims to uncover items that should be publicly available through tax-relief arrangements

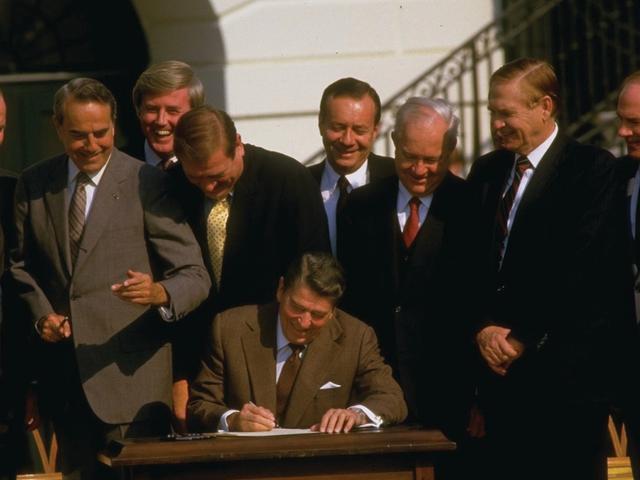

How the estate of Thailand’s missing ‘Silk King’ was among the winners of Reagan’s 1986 Tax Reform Act

The sweeping legislation cleared a hefty tax bill for the heirs of American businessman Jim Thompson, whose home and collection in Bangkok was turned into a public museum

Trump’s promise of Reagan-style tax reforms causes alarm

1986 tax package put the squeeze on donations

Why should collectors get all the breaks?

Artists seek similar tax incentives for donating works to museums and auctions

Will California collectors take their secondary market business out of state?

Panel of federal judges say 5% resale royalty law can only apply to works sold within California

How to get on with artists, handle mergers and avoid lawsuits

Legal conference tackles issues facing US museums, from commissioning work to developing diversity

Will Obama’s ‘middle-class economics’ hit inherited art?

Proposed tax reforms could make the rich feel less well-off—and less likely to spend on art

Barbara Allbritton sues IRS for $40.6m tax refund

The collector is arguing that no transfer of ownership of her collection ever took place

French trade warns of VAT ‘disaster’

Warnings that the French government's proposed VAT hikes will undermine the country's standing in the global art market

Air of malaise at Paris fairs

A scheduling clash and an unfriendly tax environment slowed business at most fairs

Californian collectors hit by tax rise

The rates for use tax and sales tax has increased to 7.5%