“Our first priority is going to be the tax plan,” Steven Mnuchin, the former Goldman Sachs executive and Hollywood producer, who is the son of the New York-based art dealer Robert Mnuchin, told the reporters gathered at Trump Tower at the end of November, soon after his nomination as the new secretary of the treasury by US president-elect Donald Trump. His promise of legislation that would result in “the largest tax changes since Reagan” caused concern among collectors and the institutions that benefit from their philanthropy.

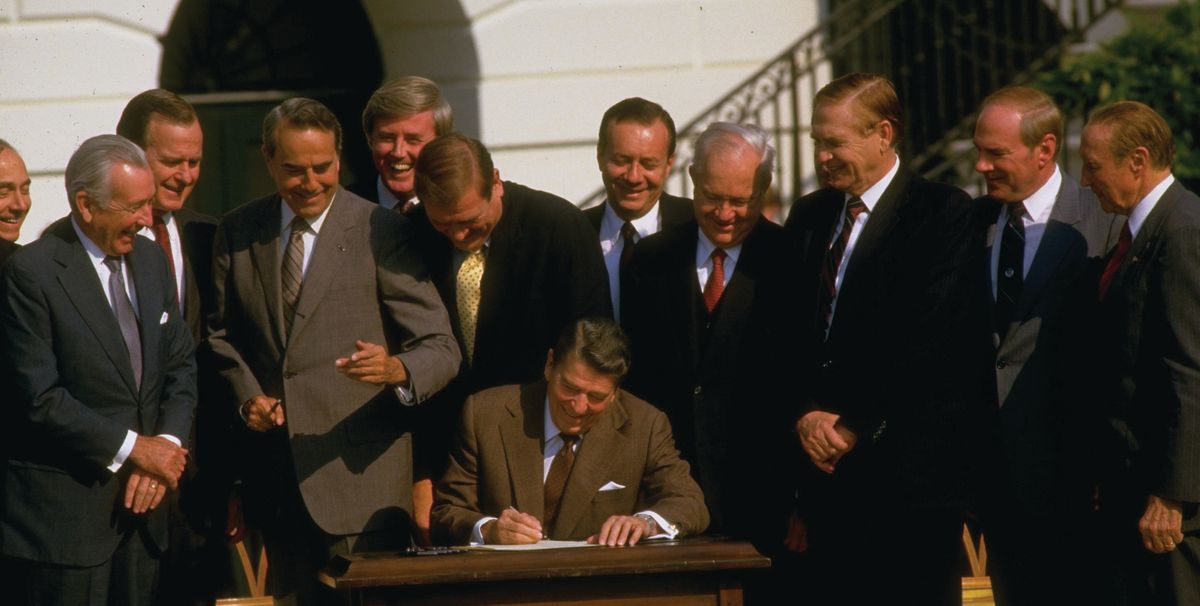

The biggest question is what will happen to tax deductions for charitable giving, and the comparison with Ronald Reagan’s historic tax cuts could be fuelling the alarm. Before the 1986 Tax Reform Act, all taxpayers could deduct the full amount of their gifts to charities; the act allowed only those who itemise their deductions—around 30% of the more than 140 million Americans who file individual income-tax returns—to do so, and they tend to earn more than $100,000 a year.

The Independent Sector, a coalition of non-profit organisations, foundations and corporate giving programmes, has asked the Trump administration and Congress to reinstate the charitable deduction for all taxpayers.

Deductions capped? Perhaps the biggest impact of the Reagan restriction, when added to changes in government funding for charities, is that it made non-profits act more like businesses. Institutions had to become more proactive in their fundraising, Using marketing and donor development techniques, rather than rely on grants.

Although Mnuchin has implied that tax breaks for charitable donations will stay, Trump has proposed an overall cap for deductions: $100,000 for individual filers and $200,000 for couples. This would combine all categories of deductions—charitable giving, mortgage interest, medical expenses, state and local taxes—into a lump sum, limiting the benefit for taxpayers making large donations, either in cash or in art.

“That cap would have the worst effect on charities,” says Nina Ozlu Tunceli, the chief counsel of government and public affairs and executive director of the Americans for the Arts Action Fund. She points to recent multi-million-dollar donations, such as David Geffen’s $100m gift to New York’s Museum of Modern Art, as a sign of how charitable giving has changed. With a current top tax rate of 39.6%, up from Reagan’s 28%, the wealthiest Americans have become more generous, partly as a way to reduce their tax bill. “The supergifts are the ones that are really escalating and would be the most affected under the president-elect,” Tunceli says.

Impact on museums These donations have become a key income stream for institutions in the US, which receive much less government funding than their counterparts in Europe. According to the American Alliance for Museums, “charitable gifts account for a full one-third of museum budgets, so it is essential that we preserve the full scope and value of the charitable deduction.”

Julián Zugazagoitia, the director of the Nelson-Atkins Museum in Kansas City, says: “The system as a way of supporting museums as well as hospitals and universities is the envy of all those European countries where support comes from the state.”

Another target in the crosshairs is the estate tax (also known as the death tax). Reagan’s Tax Reform Act set a minimum value of $600,000 for estates before they would be taxed. Trump, and many Republicans, want to eliminate it. This too could hit museums and universities, which can benefit from bequests, although many wealthy Americans set up trusts to protect their legacies from the tax man.

Trump’s proposed tax cuts would also slash federal revenue by an estimated $6 trillion over ten years, according to the Tax Policy Center, a thinktank based in Washington, DC. This could mean less funding for organisations such as the National Endowment for the Arts, public television and national museums. Trump’s plan is also estimated to increase the federal debt by $7 trillion in a decade.

While Reagan is remembered as the anti-tax president, he actually increased taxes several times to make up for the loss in revenue and tackle a ballooning deficit. “Reagan took back about half the 1981 tax cut with subsequent tax increases,” wrote the economist Barltlett, whoserved in the Treasury as deputy assistant secretary for economic policy underGeorge H.W. Bush. Even the Gipper himself seemed to recognise the flaws in hiseconomic plan. “I've been asked if I have any regrets. Well, I do,” Reagan saidin his 1988 farewell speech. “The deficit is one.”