market forces

Market Forces

Market forces still at work: why we need to look to our past to understand our future

Our first collection of archival stories looks at the major financial shifts and trends that have impacted collectors and those in the trade since 1990—and continue to be relevant today

Regulation guidelines are an ‘impossible dream’

Some think the trade was more concerned about the risk of losing sales than its reputation, observed our editor-at-large in 2015

Comment: it’s the economy, stupid—and the art market is no longer immune to its vicissitudes

While the 2008 global financial meltdown largely failed to dent sales, in 2015 our editor-at-large warned that the falling oil price experienced at the time could prove much more serious

Flipping art: filthy lucre or a sound business plan?

In 2014 we noted that market speculation can offer rich rewards, but in the long term, it may do collectors more harm than good

Jerry Saltz: 'The market is a place to support junkie-like behaviour in public'

The New York critic discussed the recession, likeability and why the market is like magic mushrooms in a 2008 panel

Market predictions for 2012: the outlook is mixed

Tough times lie ahead for galleries, but auction houses and art advisers could continue to prosper this year

Who will follow baby boomers into the art market?

Demographic change is probably the most important factor in shaping the market's future, wrote this expert in 2011

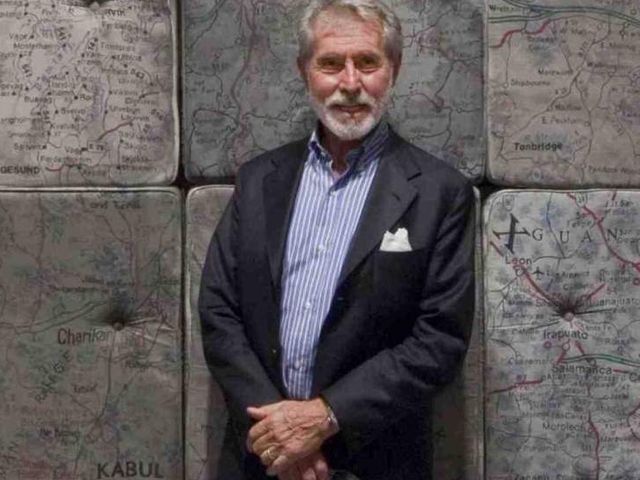

Gian Enzo Sperone: 'The nature of the art market has changed for ever'

The Italian dealer and co-founder of Sperone Westwater spoke to us in 2011 about botany, the difference between European and US galleries and why the "big gallery" systems won't last

The market bounces back from the recession as big-ticket works sell for big-bucks

But despite strong headline sales, missed estimates and cautious collectors signalled that 2010 would not be a return to the wild days

Why do certain works still set auction records during recessions

We noted in 2010, amid a painful global downturn, that a Picasso nude carried the largest pre-sale auction estimate in history at $70m to $90m

Court battle fuels calls for less art market secrecy

Lines are drawn between those who favour openness and others who prefer “handshake” culture

Could the art market be undergoing a fundamental restructuring?

2010 will be a year of continued reshaping

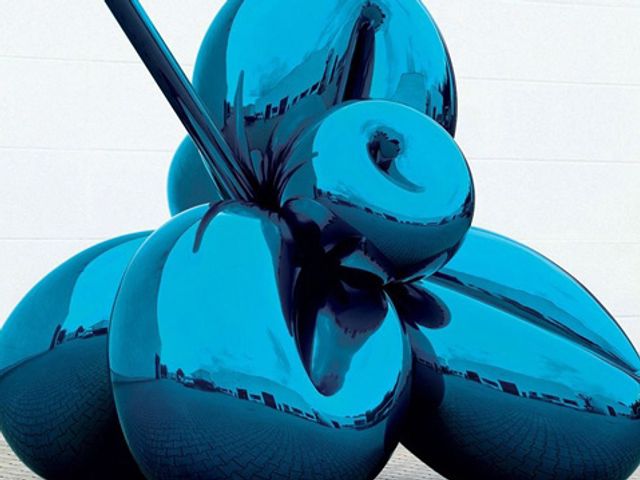

How did the financial downturn impact the market for brand-name artists like Hirst and Murakami?

Both have adopted marketing strategies more typical of luxury goods firms than artists. In 2009 we looked at their market history

How to beat the recession: cut costs, slash prices, don’t lie and be creative

During the Great Recession in 2009 we reported that gallerists must act "quickly and brutally" in order to survive

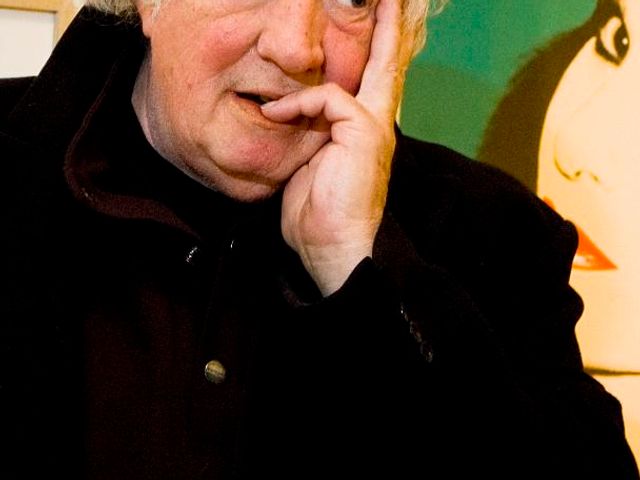

Dave Hickey: 'If you want to be an icon of virtue, this is the moment because you’ll stand out'

The outspoken cultural critic and art historian shared his thoughts on the market during a talk at Frieze art fair in 2007—here is the transcript

Mortgage crisis and resulting stock market plunge be damned—the party isn’t over yet

In 2007 we noted that strong sales at auction and fairs and more money coming from Russia, Indian and Chinese collectors indicated that confidence in art remained strong

Comment: if the hedge funders ditch art, new buyers will emerge

In 2007 the economist James Sproule examined the risks facing the market—and the good news was it was not all doom and gloom

Comment: the problem with a collector-driven market

There is a danger that money will trump knowledge, observed the New York dealer in 2007

It’s definitely a bubble, but when it will burst is anybody’s guess

The veteran dealer Richard Feigen on the state of the art market in 2007

The problem with art advisers

In 2007 we observed that while most are seen as opportunistic shoppers, some are as knowledgeable as museum curators

Comment: why an art market clean-up would be a clear-out

In 2007 the creative industries consultant noted that the “insider” aspect of the contemporary art market and hierarchy of knowledge and status that it creates was a significant part of its attraction

Why you cannot trust dealers’ prices—or auction results either

In 2006 we reported that attempts to accurately measure the market are being thwarted by auction guarantees and private sales between tight-lipped collectors

How long can this amazing art market boom last?

In recent years have seen works sold for explosive prices—and now in 2006 we are asking if this an indication of an accelerating trend or a reflection of the cyclical nature of the market?

'The art trade is the last major unregulated market'

Is it time for reform? Murky dealings came to light in 2005 as more collectors began to enter the scene—and brought their cases to court

Comment: droit de suite in the EU is bad for all art markets—and the artists it is meant to help

The British Art Market Federation chairman on Artists' Resale Right representing a serious challenge to market competitiveness in 2005

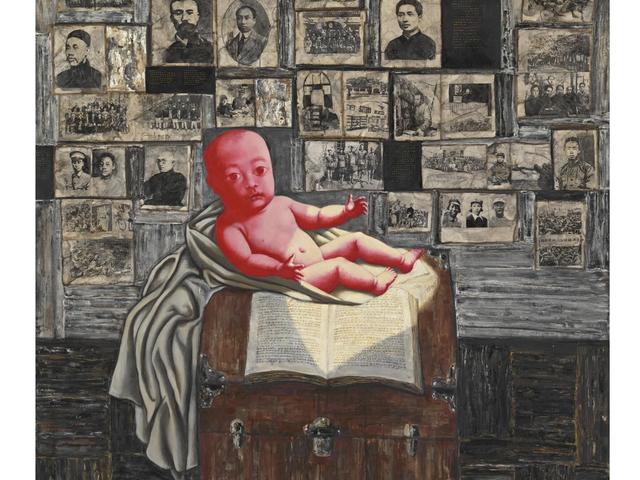

1991-2001: a mini-guide to a decade in the art market

From a game-changing Japanese scandal to price-fixing at the world's leading auction houses, we look at the most significant developments over the past ten years

Eight leading market figures on what the next recession will mean for the art world

In 2001 they predicted that some areas such as the Old Master market will remain stable but that trendy art would lose its zip

Interview with economist William N. Goetzmann: 'The financial and the art markets do not crash at the same time'

In 2001, the Yale professor attributed the one- to two-year lag between crashes to the time it takes to liquidate assets

Former Christie's director launches online venture eAuctionRoom.com

“We are a technology platform, not an auction house,” said Mark Poltimore in 2000. The onetime auction boss wants to make European sales more accessible to US and UK audiences

How the internet will change the art market: the new kids on the block are smarter than you think

The advice on how to be successful in the online world offered here in 2000 centred on building a community and having a shared sense of purpose and trust