The year 1999 saw its fair share of vertiginous hammer prices, as private collectors drove values back up to levels not witnessed since the late 1980s. Two paintings entered the top ten list of the most expensive works of art ever sold at auction.

The big names of European Modernism—Cézanne, Picasso, Van Gogh—once again accounted for some of the more spectacular sums, particularly when entering the market fresh from single-owner private collections. In general, though, prices across most categories seemed to point to a market continuing its upward climb.

All this was good news for the salerooms, but disastrous for museums, for whom the finest pictures are now virtually beyond reach of their dwindling budgets. The old question returns—how long can the market sustain such dramatic hikes in the value of individual works of art?

Bull markets

Contemporary art had a good year under the hammer, thanks to an influx of young buyers flushed with success on the booming stock markets. Old Masters also saw bullish demand, a shortage of supply of quality works forcing collectors to focus their attentions on lesser-known names, while October’s specialist London sales of German and Austrian art enjoyed another round of feverish, if selective bidding. Munch’s “Madonna”, estimated at £7m at Christie’s, was one of the year’s more prominent casualties, but the signs are that German and Austrian art—and particularly Expressionism—is still a relatively nascent market ripe for development.

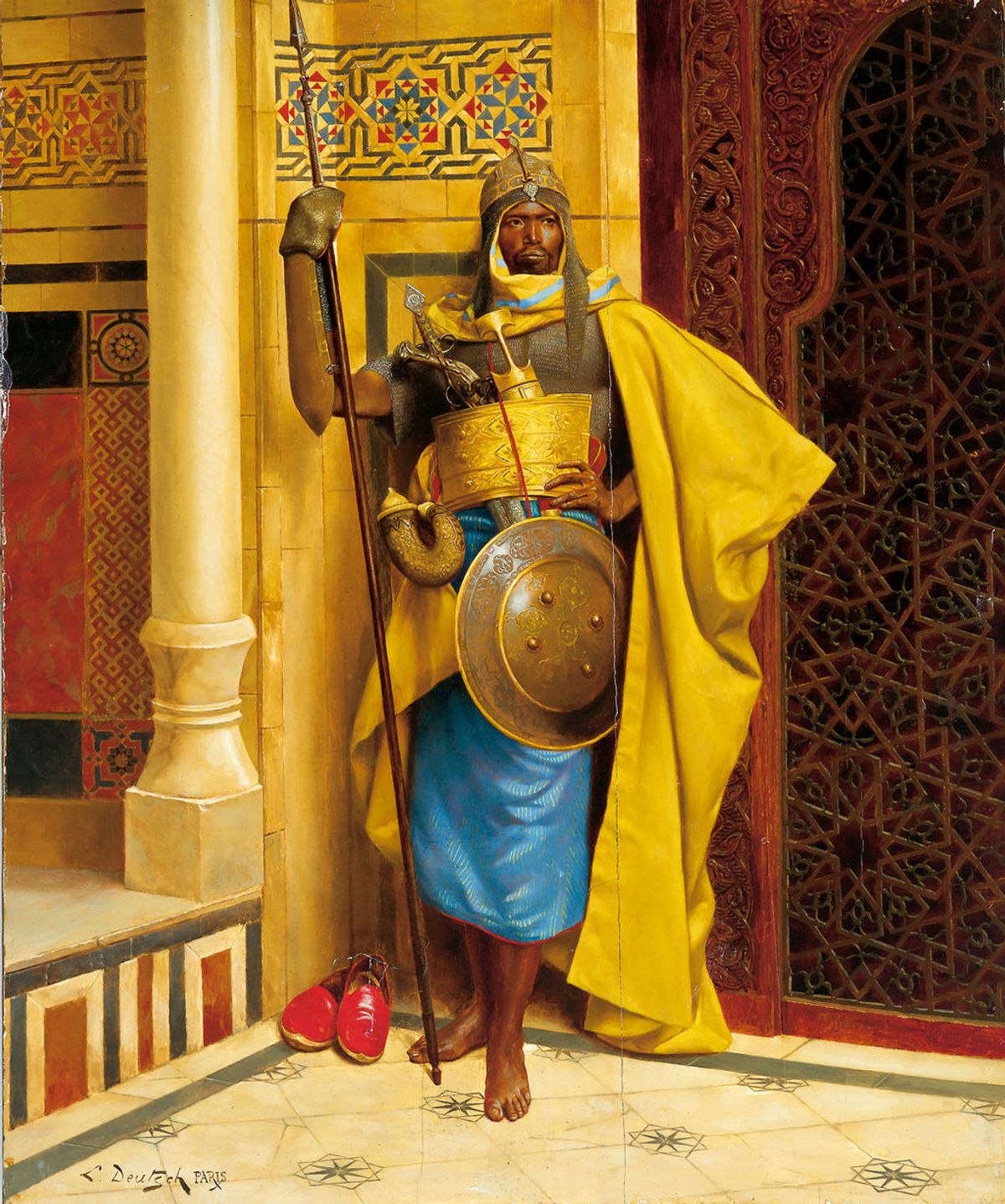

Elsewhere even traditionally marginal sale categories, such as photography, witnessed unfamiliar levels of demand, as illustrated by the record £7.4m total notched up at Sotheby’s October sale of the André Jammes collection. Orientalist pictures also continued their upward trajectory, with Gérôme finally toppled from his pedestal as the most most expensive exponent of the genre, as Ludwig Deutsch’s Palace Guard set a new record of $2.6 m at Christie’s New York in November.

Single-owner sales boost revenue

The vast majority of the year’s most spectacular fine art prices—15 out of 20—emerged from New York, where single-owner collections proved the most fertile source of blue-chip pictures. Not surprisingly, major single-owner sales were cited as the single most significant factor in boosting both Christie’s and Sotheby’s half-yearly revenues during the first six months of 1999 (up 19% and 7% respectively).

Between them, the collections of Eleanore and Daniel Saidenberg (Sotheby’s New York), that of Mr and Mrs John Hay Whitney (Sotheby’s New York), Madeleine Haas Russell (Christie’s New York) and the Rothschild collection (Christie’s London), accounted for ten of the 20 most expensive works of art sold in 1999.

The vast majority of the year’s most spectacular fine art prices—15 out of 20—emerged from New York, where single-owner collections proved the most fertile source of blue-chip pictures

The London Impressionist sales in June—at which Degas’s pastel of a ballerina fetched £17.6m at Sotheby’s—represented the highest London totals since the height of the market in 1989. The Rothschild sale in July delivered a hefty £57.7m, the highest ever total for a sale in Europe.

Digging deep

The rapturous reception given to the Rothschild sale, and the prices paid for the two Cézannes and the two Picassos at the top of the year’s list, demonstrated that when true masterpieces appear, private buyers will dig deep to acquire them. Both Cézanne’s Rideau, Cruchon et compotier and Picasso’s Nu au fauteuil noir can now be seen hanging in Steve Wynn’s Bellagio Casino in Las Vegas.

In London, Christie’s continued to attract the new breed of wealthy young collectors to their Clerkenwell warehouse sales of contemporary art, competing openly with the galleries by marketing the work of young British artists. More evidence emerged that buyers are playing this market for short-term gain.

The extraordinary response to Christie’s June sale of sculpture by Julio Gonzalez from the Hartung Foundation saw the artist’s Tête de femme reach a record £2,036,500, against a £180,000 to £200,000 estimate. Although recognised by both the trade and private collectors as a rare opportunity to acquire undisputed masterpieces by the artist, the prices at the Gonzalez sale nevertheless revealed as much about the salerooms’ continuing tendency to underestimate.

Fine art aside, one ought not overlook the significance of celebrity collector sales in stimulating auction business. Christie’s New York dispersal of the Marilyn Monroe collection in October—which saw her “Kennedy birthday dress” reach $1.27m (£750,000)—was a highlight of the 1999 auction calendar. More than 1200 people registered to bid at the sale and catalogue revenue alone totalled $2.38m.

Oh, what a tangled web...

While rising prices for fine art and collectables remain an important index of the vitality of today’s art market, such is the continuing impact of e-commerce on traditional saleroom business that last year was as notable for a string of multi-million-dollar corporate mergers as for traditional saleroom records.

In April, California fine art auctioneers Butterfield and Butterfield were acquired by online person-to-person trading community eBay for $260m, and in June Sotheby’s announced a $45m co-operative venture with Amazon.com. Their joint website finally launched in November. The same month saw the acquisition of Phillips by Bernard Arnault’s LVMH luxury goods group for a figure reported to be in excess of £70m, and in January 2000 Sotheby’s launched its independent fine art website, sothebys.com.

The coming year is sure to bring further developments in art-related e-commerce ventures as the traditional fine art market continues to fragment.

Finally, in terms of the impact of legislation, results during the second half of the year indicated that London was surviving, despite the imposition of 5% VAT on imports from outside the EU, although there are those who maintain that the London art market is steadily drifting towards the US.

Meanwhile, a decision on droit de suite—the artists’ resale right—has been postponed until the next European Parliament when the Portuguese begin their Presidency. Recent evidence that it fails to offer any significant benefit to living artists has helped to bolster opposition to the levy.

Until it has been officially kicked into touch, the lobbying should continue.

• Originally appeared in The Art Newspaper with the headline "Is this another bubble about to burst?"