Sotheby’s closed out a week of high-stakes evening auctions in New York on Thursday 15 May with a successful three-part sale that consistently hit the auction house’s targets. And though there were minimal fireworks, there were also no major flops—no small feat given the fears of recession hanging over the spring sales prompted by US President Donald Trump’s global trade war and uncertainties about shifting tariff regimes.

The night began with a 12-lot suite of works from the estate of the late US dealer Barbara Gladstone (1935-2024), which was 100% sold and brought in a hammer total of $15.1m ($18.5m with fees), squarely within its estimate of $11.9m-$17.2m (estimates are calculated without auction house fees). It was followed by a selection of 15 works from the collection of Daniella Luxembourg, all of which had a sales guarantee. The Luxembourg lots brought a hammer total of $33.6m ($40.4m with fees), right in their pre-sale estimate range of $28.3m-$41.1m.

The night’s main sale, Sotheby’s The Now and Contemporary evening auction, featured 41 lots (after three withdrawals), including nine works from the collection of Dorothy and Roy Lichtenstein and three works deaccessioned by US museums. With three lots bought in, it achieved a 93% sell-through rate by lot, bringing a hammer total of $105.4m ($127.1m with fees), on the lower side of Sotheby’s $101.4m-$146.6m estimate.

Andy Warhol, Flowers (1964)

Courtesy Sotheby's

All rolled up, the night’s total result from the 68 lots offered was $154.2m (nearly $186.1m with fees), comfortably within the estimate range of $141.5m-$204.9m. That total represents a 61% jump from the equivalent sale last autumn, which despite an overperforming fruit tallied just $96m ($112m with fees) across 37 lots. The same sale a year ago brought in $227.9m (nearly 48% more) from just 52 lots, underscoring how much the market has continued to cool over the past 12 months. Given that dynamic, the Sotheby’s team had reason to be pleased, especially given the house’s $70m flop two nights earlier.

“That was a real testament to the depth of bidding this season,” Lucius Elliott, Sotheby’s senior vice president and head of contemporary marquee auctions, said after the sale. He noted that clients registered to bid on the evening’s lots were overwhelmingly from the US—no surprise given the looming changes to import and export duties, but still impressive given that one of the night’s single-owner collections (Luxembourg’s) largely consisted of Italian Arte Povera material.

“Ten years ago, Italian art was mostly sold in European salesrooms, and this shift really started happening on a wider scale about ten years ago, as artists like Lucio Fontana, Alberto Burri and Michelangelo Pistoletto started commanding global attention—and someone like Daniela has been really pivotal in that shift,” David Galperin, the vice chairman and head of contemporary art in New York, said before the sale. “She was one of the earliest champions of post-war Italian art outside of Italy, and you can see this in the choices she made and the pieces she acquired.”

‘The ultimate seal of excellence’

The night began with the 12 works from Gladstone’s estate, none of which had been guaranteed and five of which ultimately sold for prices above their high estimates. Among those was a rather punk Andy Warhol Flowers canvas from 1964 with black blossoms set against neon-green foliage. It set off a bidding war with two clients dialling into the sale. Ultimately, the bidder on the line with David Schrader, Sotheby’s chairman of global private sales, prevailed with a hammer price of $3.1m ($3.8m with fees), more than double the high estimate of $1.5m.

“There are only four black flower on green background works in this size, and we’re so accustomed to seeing the colourful flowers—something like this is so rare and unique and speaks to Barbara’s aesthetic,” Galperin said.

Also speaking to Gladstone’s aesthetic—and her gallery’s artist roster—was Carroll Dunham’s cheeky canvas Bathers Seventeen (Black Hole) (2011-12). It quickly surpassed its high estimate of $350,000 and was eventually knocked down by auctioneer Oliver Barker for a hammer price of $600,000 ($762,000 with fees)—good for a new secondary market record for Lena Dunham’s dad.

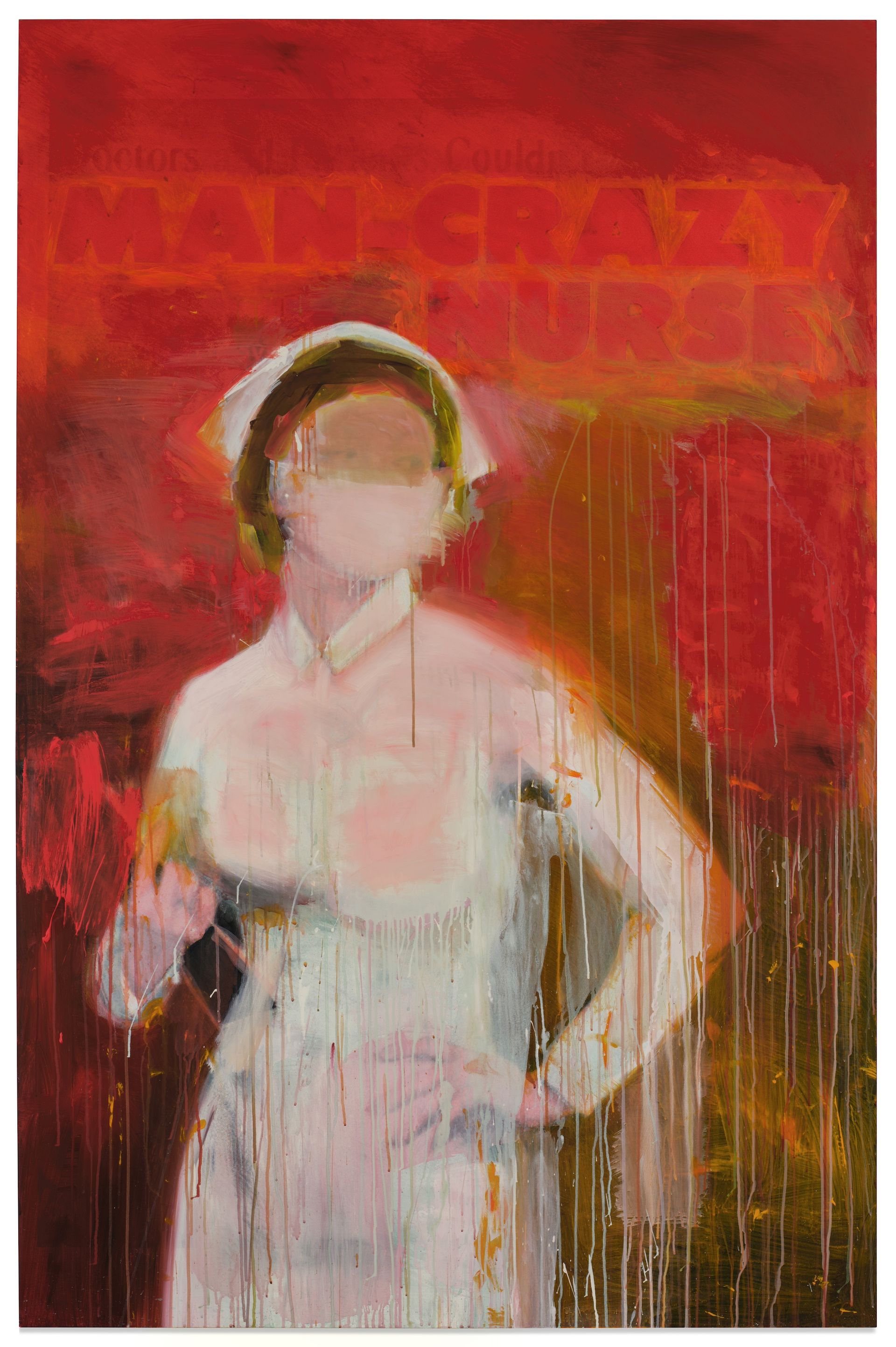

Richard Prince, Man Crazy Nurse (2002-03)

Courtesy Sotheby's

The top lot from Gladstone’s works, both by estimate and final price, was Richard Prince’s drippy 2002-03 canvas Man Crazy Nurse. Though it failed to reach its low estimate of $4m, it sold for a hammer price of $3.5m (just shy of $4m with fees).

All 15 of the works from Luxembourg’s collection had been guaranteed, and 11 were also backed by irrevocable bids. Even so, the group elicited strong bidding and every lot sold for a hammer price within or above its estimate range. The lot with the highest estimate of the entire night was Lucio Fontana’s epic, glittery slashed oval canvas Concetto spaziale, La fine di Dio (spatial concept, the end of God) (1963), which came with an estimate of $12m to $18m and quickly sold for a hammer price of $12m ($14.4m with fees).

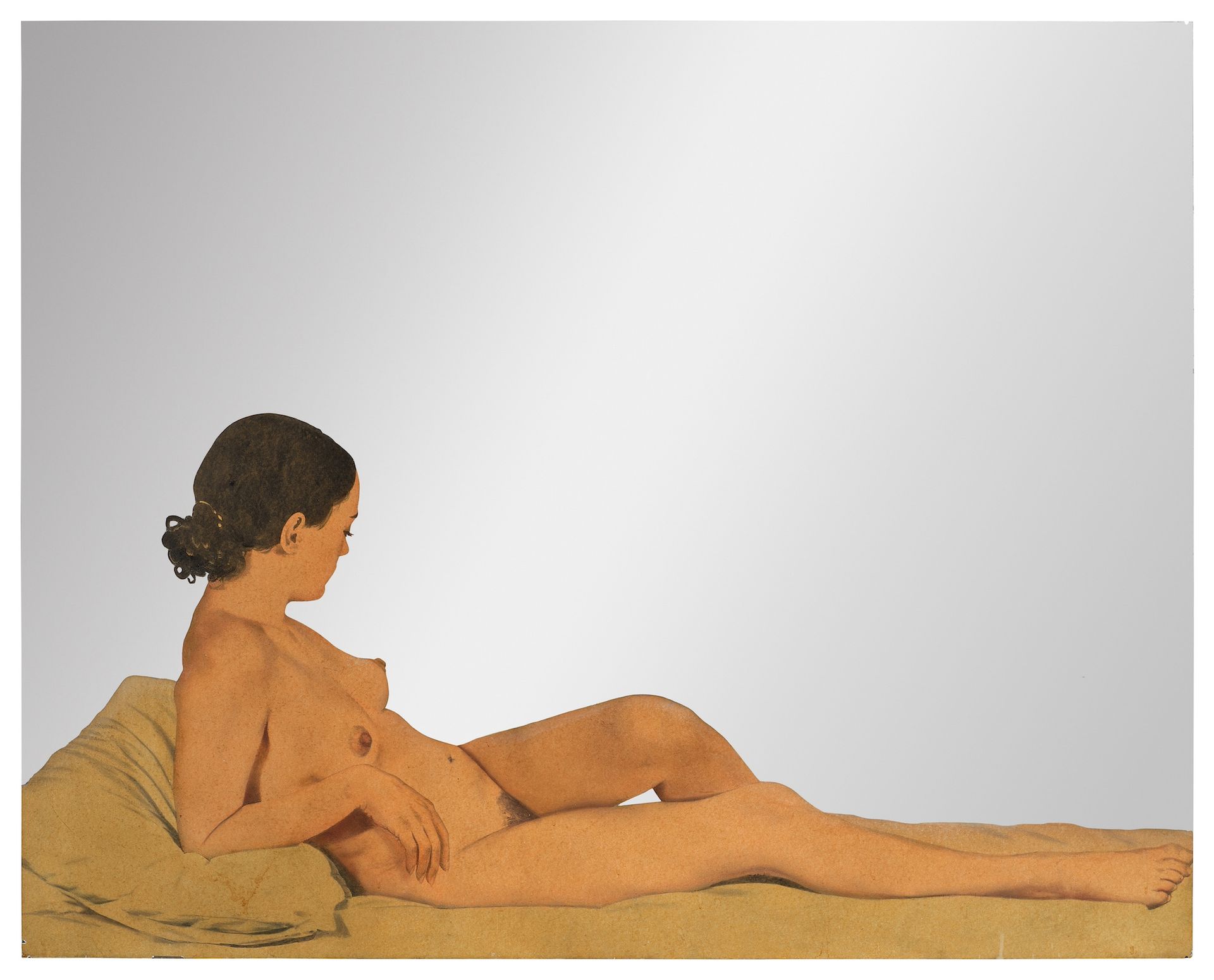

Michelangelo Pistoletto, Maria nuda (1969)

Courtesy Sotheby's

Most other Italian works in the sale saw competitive bidding, among them Pino Pascali’s 1968 composition of steel wool, Tappeto, which glided past its high estimate of $600,000 and ultimately sold to a bidder in Sotheby’s York Avenue saleroom for a hammer price of $1.3m ($1.6m with fees). The night’s most contested lot was a canonical Michelangelo Pistoletto mirror piece, Maria nuda (1969), which features the artist’s wife in a classical reclining nude pose. Eight bidders in all, including two in the saleroom, chased after it. The phone bidder on the line with Claudia Dwek, Sotheby’s chairman of contemporary art for Europe, won with a bid of $2.75m ($3.4m with fees).

“The halo effect of these types of collections is undeniable,” Elliott said after the sale. “Being in [Gladstone’s and Luxembourg’s] personal collections is the ultimate seal of excellence, albeit for very different genres of art.”

Lichtensteins and the latest stars

After the halo of the single-owner sales dimmed, the night’s 41-lot multiple-owner auction was more mixed, although the overall result was robust. Some of the sale’s biggest lots—both by estimate and by size—failed to sell, while works by emerging artists generally fared well, as did the trove of Lichtenstein works.

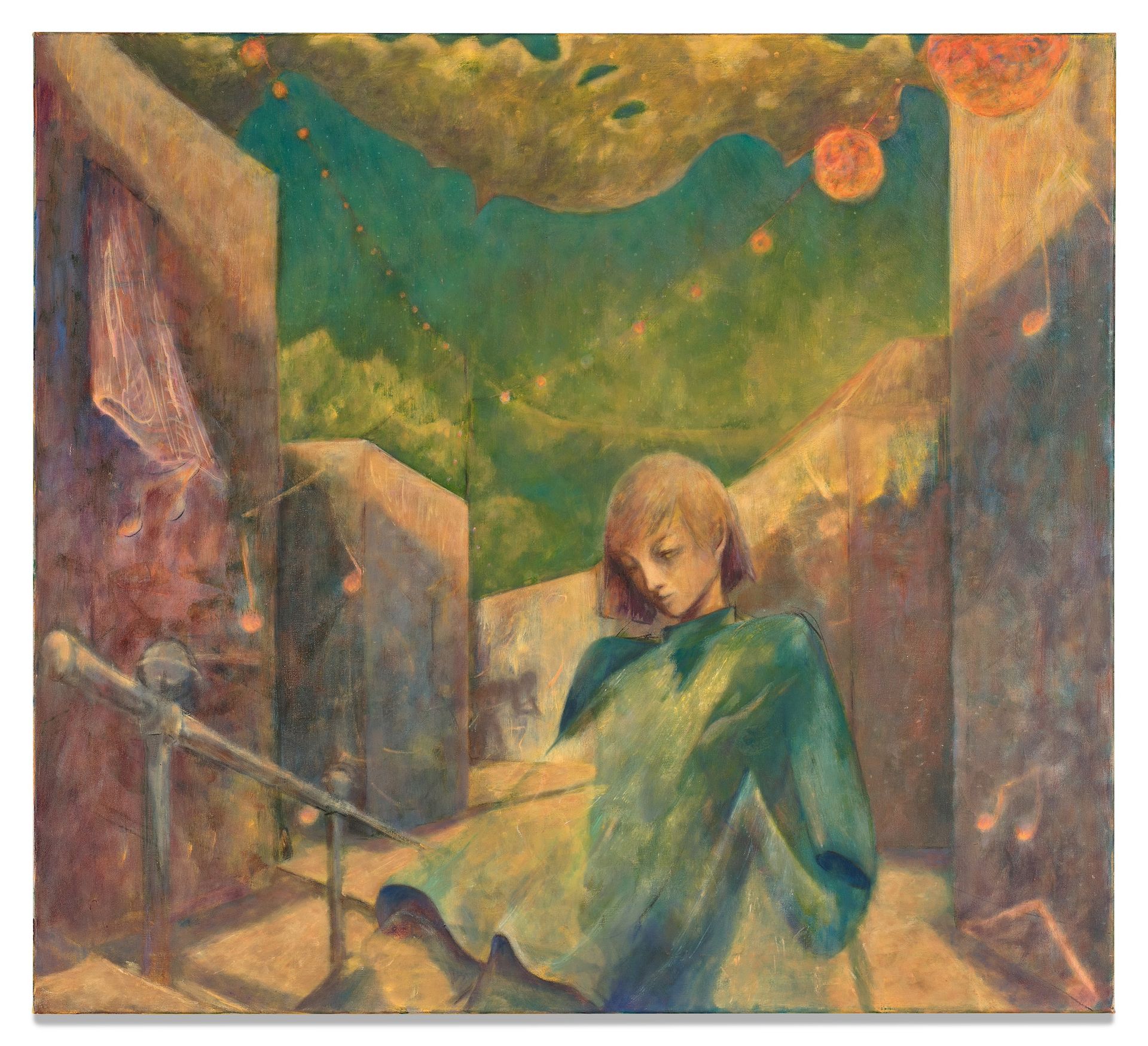

Ernst Yohji Jäger, Untitled (2021)

Courtesy Sotheby's

One of the lots with the highest estimate, Frank Stella’s shaped canvas Adelante (1964), had been in the permanent collection of SFMoMA since 1968 and was being sold to support the museum’s acquisition fund. But after just two bids it sold for a hammer price of $6.5m ($7m with fees), well short of its $10m low estimate. Another monumental work, Urs Fischer’s 8ft-tall Blanched (2011)—featuring a photorealistic, bas-relief rendering of a bent bolt affixed to a canvas with a photorealistic image of a woman—became the night’s first bought-in lot after bidding stalled at $350,000, well short of its $500,000 low estimate. The next lot, Cecily Brown’s large group composition Burkini Kill (2016), estimated to fetch $1.8m-$2.5m, failed to garner any bids and went unsold.

Momentum returned with the next two lots, paintings by emerging artists with five-figure estimates. An untitled 2021 canvas by Ernst Yohji Jäger quickly vaulted its $80,000 high estimate and sold to a bidder in the salesroom for a hammer price of $150,000 ($190,500 with fees), more than doubling the young German artist’s previous auction record, set last May at Christie’s. A large painting by Yu Nishimura, the recent David Zwirner signee, across the place (2023), was next and overperformed even more dramatically. It eventually hammered for $320,000 ($406,400 with fees), more than quadrupling its $70,000 high estimate and setting a new record for the Japanese painter.

Roy Lichtenstein, Reflections: Art (1988)

© Estate of Roy Lichtenstein

The nine Lichtenstein lots on offer—split into two blocks and all backed by guarantees—also overperformed, with five selling for hammer prices above their high estimates. Chief among the group was Reflections: Art (1988), a large canvas installed right above the rostrum featuring the word “ART” rendered in the artist’s classic Ben-Day dot style.

“It’s what we’re all doing here,” Barker said as he introduced the lot. “It’s why we’re here.” A bidding duel between clients on the phones pushed it past its $4m low estimate, and it ultimately hammered to the buyer on the line with Jacqueline Wachter, the head of Sotheby’s Los Angeles, for $4.4m ($5.4m with fees). All the Lichtenstein works—three on paper, three paintings and three sculptures—sold, bringing in a total hammer price of $23.4m ($29m with fees).

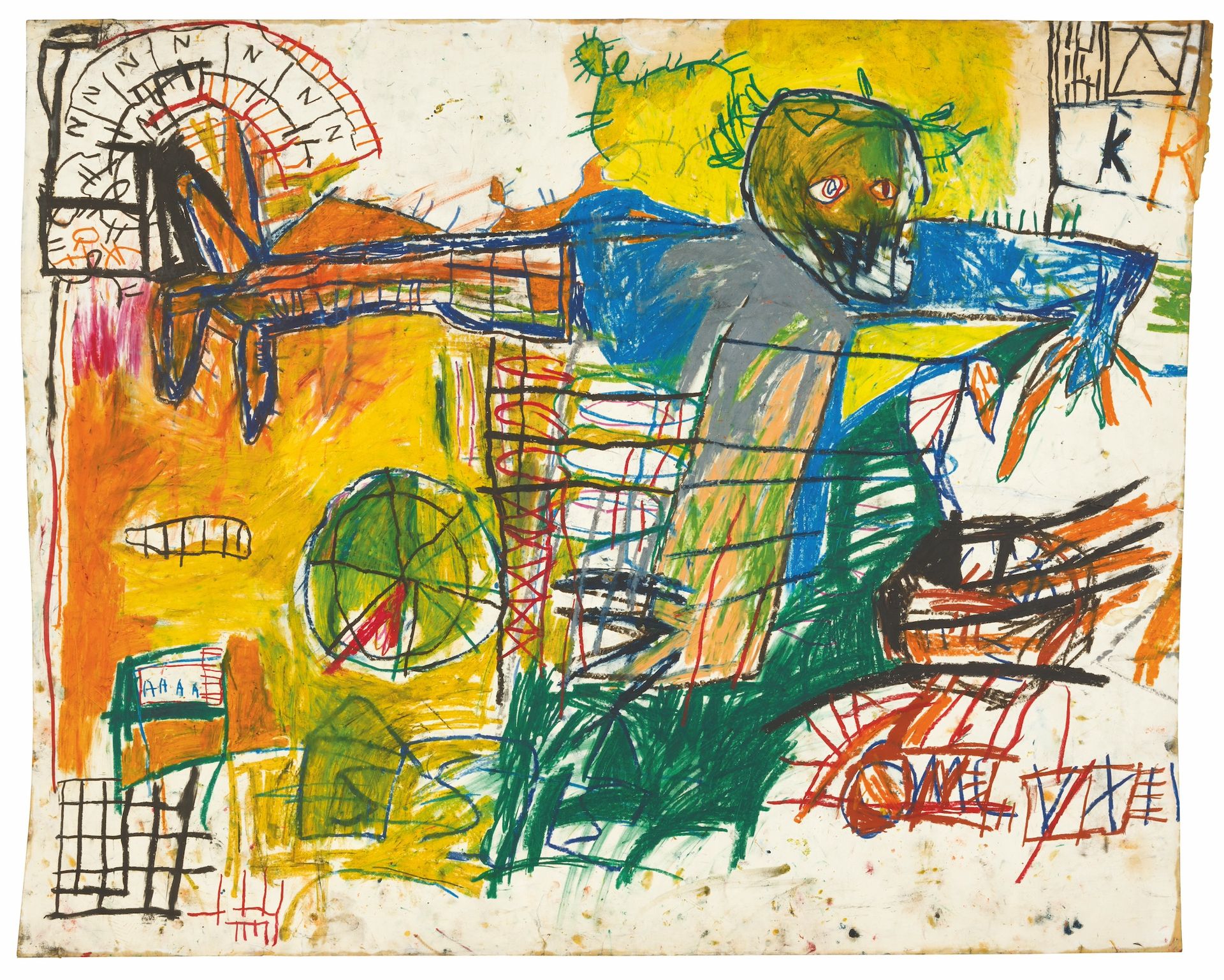

Jean-Michel Basquiat, Untitled (1981)

Courtesy Sotheby's

And, to be sure, no contemporary art evening auction in 2025 would be complete without a significant Jean-Michel Basquiat work, and Sotheby’s lined up two. Gravestone (1987), a freestanding composition across three hinged wood panels, was a tough sell and ultimately hammered at $4.2m ($5.1m with fees), well short of its $6m low estimate. But a bright, untitled work on paper from 1981 with a figure emerging from a field of bold colour gradients set off one of the night’s longest bidding wars. It ultimately sold for $13.7m ($16.3m with fees), within its estimate of $10m-$15m. Elliott said: “That result for a work on paper is a testament to the depth of Basquiat’s market.”

Ultimately it was a reassuringly on-estimate night at the end of a jittery auction week in New York. Sotheby’s wraps things up on Friday 6 May with its day sales of contemporary art. Next week the auction house will travel back in time to sell works from the collection of Jordan and Thomas A. Saunders—expected to become the most valuable single-owner Old Masters collection ever to come to auction, with an estimate of $80m to $120m.