Prominent art adviser Lisa Schiff has reportedly closed her business, SFA Advisory, after longtime clients accused her of using sales proceeds to defraud them as part of a system of deception allegedly operated through her companies.

Collectors Candace Carmel Barasch and Richard Grossman filed a lawsuit in New York Supreme Court on 11 May claiming that Schiff failed to pay them $1.8m that she owed after brokering the sale of a painting at Sotheby’s Hong Kong. Court documents list five counts of breach of contract, conversion, fraud, breach of fiduciary duty and conspiracy.

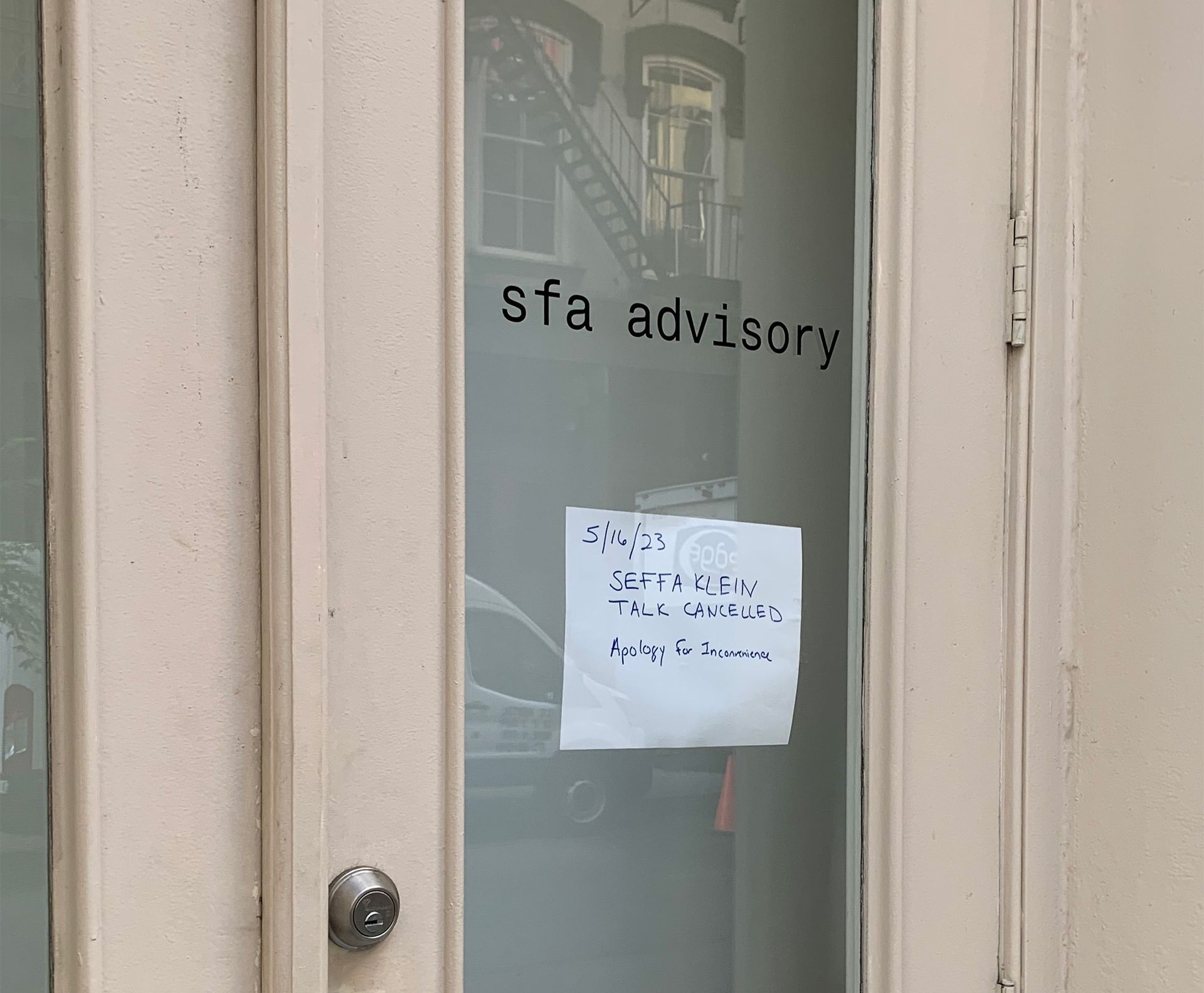

On Tuesday (16 May), Artnews reported that SFA Advisory’s Tribeca storefront appeared to have closed. Multiple attempts to reach Schiff and her lawyer John Cahill went unanswered.

“Schiff and her businesses have effectively been running a Ponzi scheme, taking funds, accounts and artworks entrusted to them by clients, and using them and their sale proceeds, upon information and belief, to fund Schiff’s own lavish lifestyle,” the complaint reads. Those personal expenses, it continues, include “a New York apartment rented at $25,000 per month, international first class travel with concierge services and limousine services, including vacations at five-star hotels, shopping sprees in New York and Europe for designer clothes and jewellery, private school tuition for her child, among other things, and to make payments owed to other clients of Schiff and her businesses”.

Schiff and her companies Schiff Fine Art and SFA Advisory are named as defendants, along with ten defendants of unknown identities.

Schiff's Tribeca space, SFA Advisory, was closed on 17 May and a sign in the door announced the cancelation of a planned event The Art Newspaper

The dispute revolves around the 2019 painting The Uncle 3 by Adrian Ghenie, which Schiff brought to Barasch’s attention as a potential purchase in April 2021. Barasch co-purchased it with Grossman and his spouse, with Barasch acquiring a 50% share and the latter two each a 25% interest. In December 2022, the three owners, in a deal brokered by Schiff, resold the work through Sotheby’s Hong Kong for $2.5m. The lawsuit says they entered into an oral agreement under which Schiff was to receive a 10% commission of the net purchase price, ultimately equal to $250,000. Sotheby’s declined to comment.

In January, Schiff sent Barasch and Grossman each $225,000, allegedly promising that the remaining sales proceeds, totaling $1.8m, would arrive by 26 March. She then requested a month-long extension, asserting that it was “an accommodation to the purchasers in Hong Kong”, the lawsuit says, and then an additional two-week deferral.

On 8 May, the date payment was due, Grossman’s spouse allegedly confronted Schiff about the missing money only to be told that she did not have it, and to call her attorney. Subsequent communications with Schiff’s attorney “indicated that Schiff cannot pay the funds owed…and that this is actually just the tip of the iceberg”, the lawsuit says. “Plaintiffs are now the victims of the latest art swindler, for which they are forced to seek redress from the Court.”

Grossman and Barasch have both known Schiff for close to two decades, and considered her family as well as a trusted adviser, they say. Barasch, who has credited Schiff with helping her make “informed decisions”, also says she received a phone call from Los Angeles dealer David Kordansky last summer to follow up on a payment for a work she had purchased through Schiff. “Based on information which Plaintiffs have recently learned, Defendants’ failure to timely pay the Kordansky Gallery was part of Defendants’ scheme to defraud their clients,” the complaint says.

Barasch and Grossman are seeking a jury trial and asking for more than $2m in damages. In addition, they claim they are owed the $250,000 commission Schiff earned from the sale, plus interest and are entitled immediate possession of the painting. Its whereabouts are currently unknown to them.

CLARIFICATION: A Sutton spokesperson confirmed to The Art Newspaper that the firm no longer acts as Lisa Schiff's public relations representative.