It is an uncomfortable but inevitable truth that, while Russian president Vladimir Putin continues his brutal invasion of Ukraine and threatens “high precision” missile strikes on Kyiv, London’s auction houses must continue regardless with their major spring sales series.

Speaking yesterday, the London-based private art dealer Nicholas Maclean, of Eykyn Maclean, said he struggled to know how to comment: “It all feels so irrelevant to be talking about buying art at a time like this. It doesn't seem right to call up a client and say, 'Have you thought about bidding on this work,' given what is going on in the world at the moment. You start to wonder if it will be just the hyenas left. But I actually think the market is deep enough that these sales will be OK.”

While, as Maclean says, “the Russians are almost certainly not going to be bidding”, the art market has not relied on them for some time—it is US and Chinese bidders that auctions rely upon now.

Melanie Clore, the co-founder of the London-based advisory firm Clore Wyndham, concurs: “Even though there is an amount of uncertainty given the terrible situation in the Ukraine, I do not feel that the sales will be overly effected. Whilst of course every situation is different, historically neither the 2008 financial crash nor the pandemic had an immediate impact on the art market. This may be as a result of the global nature of the art market, which doesn’t therefore rely on Russian activity.”

She adds: “I think that Russian buyers have been active to a certain degree over the last few years, but their withdrawal from these sales should not have a dramatic effect over the market in general.”

Today, London’s sale week kicked off with Christie’s endurance-testing, five-hour, Shanghai to London relay auction of 20th and 21st century art—with a Surrealism sale tacked on to the end. Incorporating the first-ever livestreamed sale from mainland China into London’s traditional mid-season sale week attests to the importance of Chinese buyers and the sprawling 110-lot jumble offered something for everyone—from an Eugène Boudin painting from 1863 to a World of Women NFT (non-fungible token) from 2021, jumping back and forth from a 1912 Hermann Max Pechstein to a 2017 Matthew Wong and 2020 Serge Attukwei Clottey then back to a 1954 Picasso.

The roughly equivalent sale at Christie’s in March 2021 (which included a single-lot Basquiat auction, then a 20th century art and Surrealism sale) brought in a combined £198.7m (with fees), from 82 lots.

Today, the Shanghai and London auctions plus the Art of the Surreal sale realised a combined £249m (with fees) from 110 lots, within the pre-sale estimate of £208.5m-£298.8m (calculated without fees). The combined sell-through rate across all three sales was 90% by lot.

The sale kicked off from Shanghai at Christie’s new headquarters at Bund One, with 20 lots of market darlings that brought in £26.4m (with fees, RMB222m) against an estimate of £19.4m to £29.4m (estimates are calculated without fees). None of the works were guaranteed. The top lot of this portion was Basquiat’s 1982 Il Duce, which sold on its low estimate for £9.5m (RMB80m, or £11.2m/RMB94.1m with fees). Most of the paintings sold here were a little fresher (or wetter), however, catering to young Chinese investor tastes, such as Amoako Boafo’s Orange Shirt (2019), which sold for £832,884 (RMB7m, or £1m/RMB8.7m with fees) and Joel Mesler’s Untitled (You Deserve Great Things) from 2020, which made £535,425 (RMB4.5m, or £666,307/RMB5.6m with fees).

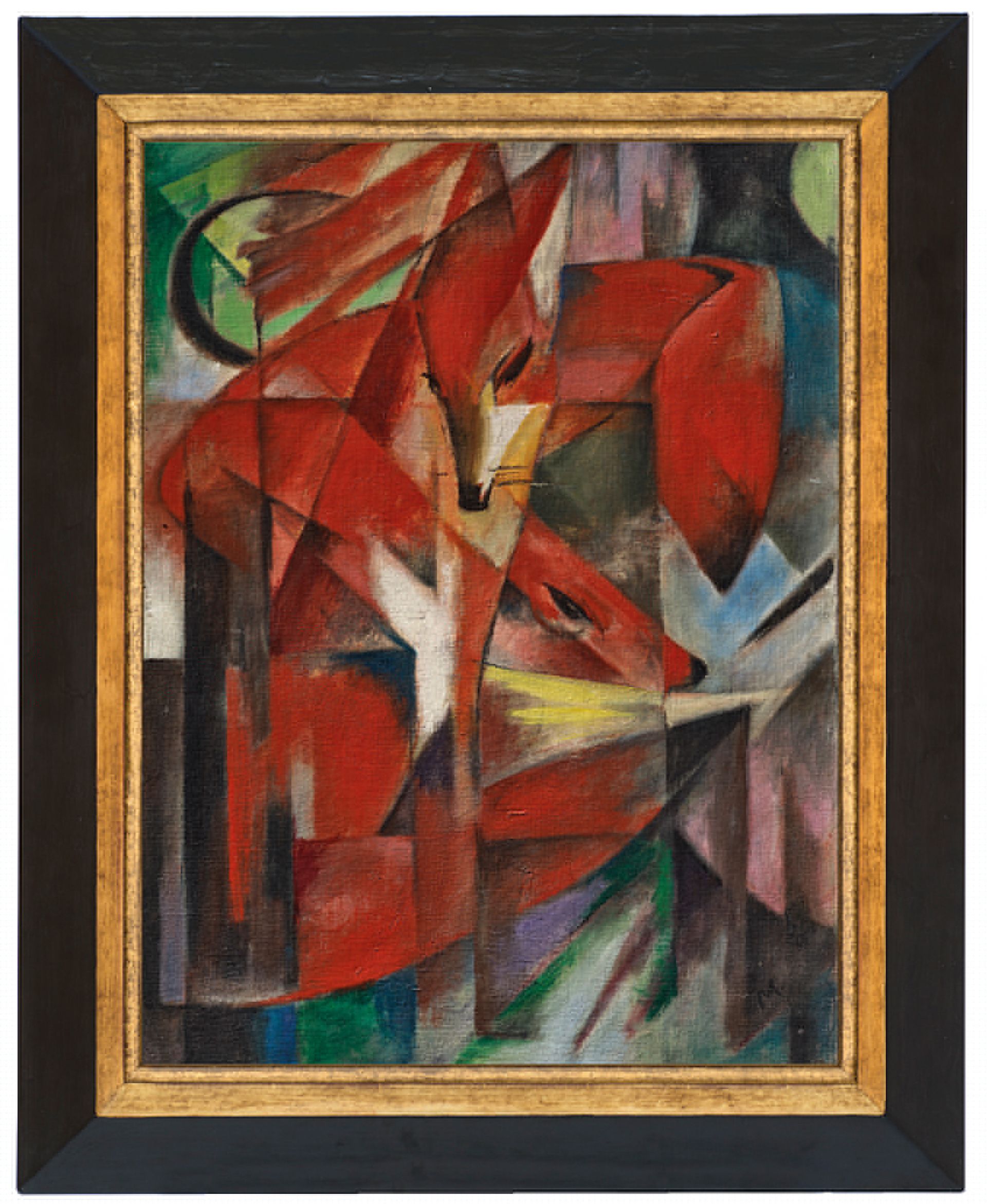

Franz Marc, The Foxes (Die Füchse), 1913 Courtesy Christie's

Then to London for the main 68-lot part of the sale, which totaled £155.8m (£182.6m with fees) just below the estimate of £158.2m to £221.1m. The star here was undoubtedly the German Expressionist Franz Marc’s quietly enthralling painting The Foxes (Die Füchse) from 1913, a depiction of innocence on the brink of the First World War—a war during which Marc was killed while serving in the German army.

Between 1928 and 1940, the work was owned by the Jewish investment banker Kurt Grawi and his wife, Else, who were forced to flee Berlin under the Nazis—they sold the painting to pay for their emigration to Chile. In 2015, the Grawi’s heirs started a campaign to claim back the work, which was by then hanging in the Museum Kunstpalast in Düsseldorf. It was finally restituted last year. The Art Newspaper understands the vendors turned down some private offers for the work before the sale, preferring instead to give it the auction treatment, albeit backed by a third-party guarantee. With a confident estimate in excess of £35m, the painting smashed all previous records for Marc's work, selling for £37m (£42.6m with fees).

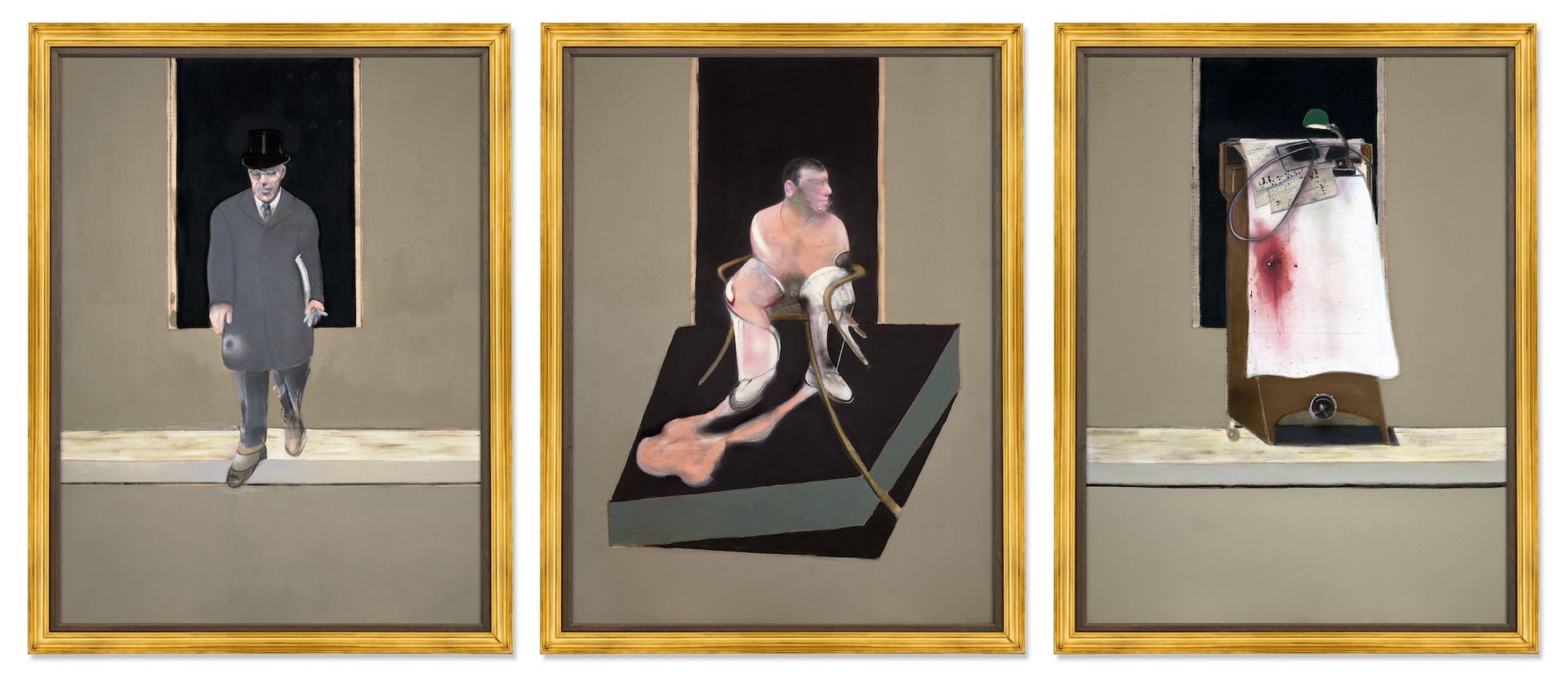

Francis Bacon, Triptych, 1986-7 Courtesy Christie's

Meanwhile, Francis Bacon's big Triptych of 1986-7 (which was reportedly being sold by the architect Norman Foster according to Katya Kazakina of Artnet News—Christie’s declined to comment) came in as the second-highest selling work, but without fanfare. Guaranteed by a third party, it was knocked down to Katharine Arnold’s phone bidder on the low end of its £35m to £55m estimate (£38.4m with fees). These triptychs do not come up often, but this one was rather later than is most desired and for some the subject matter was not quite premium Bacon—at least, not quite £35m-£55m premium Bacon.

Bacon’s friend Lucian Freud followed—his Girl with Closed Eyes, also painted in 1986-87, was the third-highest selling work of the sale at £13m (£15.1m with fees), in the midst of the £10m to £15m estimate. It was not guaranteed but the following lot—a much-admired drawing of a lobster done by Freud on a trip to Swanage with his friend John Craxton in 1944 when he was just 21—did carry a third-party guarantee. Estimated at £1.3m to £1.8m, it sold for £1.6m (£1.9m with fees).

Lucian Freud, Lobster, 1944 Courtesy Christie's

Elsewhere, there was keen bidding for Peter Doig’s Some Houses on Iron Hill, a relatively small canvas from 1992 that was fresh to market, having been bought by the vendor from the Whitechapel Gallery in the year it was made. With bidding from Shanghai, New York and London, the work sold for £2m (£2.4m with fees) to a New York phone bidder, against a fairly conservative estimate of £600,000 to £800,000.

As is common practice now, the sale was front-loaded with almost-still-wet paintings by the market’s current young darlings, unattainable on the primary market, and offered here with “gallery price” estimates that they were never going to sell for. So, Flora Yukhnovich’s luscious Rococco riff, Tu vas me faire rougir (You're going to make me blush), bought from the artist’s MA show at the City & Guilds of London Art School in 2017, went for £1.5m (£1.9m with fees) against an estimate of £250,000 to £350,000. “We’ll go in 50s, OK. No splitting,” auctioneer Jussi Pylkkänen told the Christie’s phone bidder banks as he started bidding at £850,000.

There was also competitive bidding for Victor Man’s captivating little painting, D with Raven (2015), which was the first work by the artist to be offered at a Christie’s evening auction. Estimated at £20,000 to £30,000, it went for a record £170,000 (£214,200 with fees).

Victor Man, D with Raven, 2015 Courtesy Christie's

The Art of the Surreal sale, concluding the marathon run, totalled £33.4m (£39.8m with fees, est. £30.8m-£48.2m), led by Picasso’s La fenêtre ouverte (1929), which went for £14m (£16.3m with fees) against a broad £14m to £24m estimate.

Speaking after the sale, Katharine Arnold, Christie’s head of post-war and contemporary art for Europe, and Giovanna Bertazzoni, Christie’s vice-chairman of 20th and 21st century art, commented: “We are saddened by the escalation of the situation in Ukraine. We have seen from tonight and remain confident that the sales will be unaffected. The response from visitors to King Street to the works presented across our view has been incredibly positive and the visitor numbers to our online content about the sale is also very encouraging. In addition, individual meetings between our team and their clients showed interest and demand remains high.” With regards to Russian buying, they said: “We don’t have comment on such specific client demographics.”