After two years of remote work, National Australia Bank (NAB) staff have recently returned to bare office walls as the bank prepares to sell off its corporate art collection.

According to the bank’s chief operating officer, Les Matheson, the collection is no longer “core to our role as a bank”. And over the next 12 months NAB will divest its portfolio of 2,500 works including paintings by Jeffrey Smart, John Olsen, and Howard Arkley at two auction houses—Deutscher and Hackett and Leonard Joel.

But it is the bank's decision to use the proceeds to top up its grant programme for communities affected by climate change that has raised eyebrows.

On Instagram, the prominent Australian artist Ben Quilty pointed out the irony of “one of the biggest financial facilitators of fossil fuel developments” announcing it was “proudly redirecting” funds to help those affected by natural disasters. “This is a bit much” he posted.

For those with an eye on the bank, the perceived gains from the auction are outweighed by the losses.

With a valuation of Aus$10m (US$7.2m), divesting at auction will attract a minimum tax rate of 27.9% under Australian tax law, not to mention the auction houses' fees. Had NAB pursued donating the collection to a cultural institution under the Federal Australian Government’s Cultural Gifts Program they stood to gain Aus$10m in tax credits.

Despite the obvious shortcomings, Matheson, who joined NAB in January 2021 from the Royal Bank of Scotland, tells The Art Newspaper he believes an auction is the “fairest method” to sell the collection.

The auction also marks an end to almost 50 years of supporting Australian artists through acquisition, at a time when many are struggling.

For the artist Lesley Dumbrell, whose painting Chinook was purchased by the bank in 1975, the acquisition “meant a lot” and marked a turning point after failing to sell anything in her two first solo exhibitions.

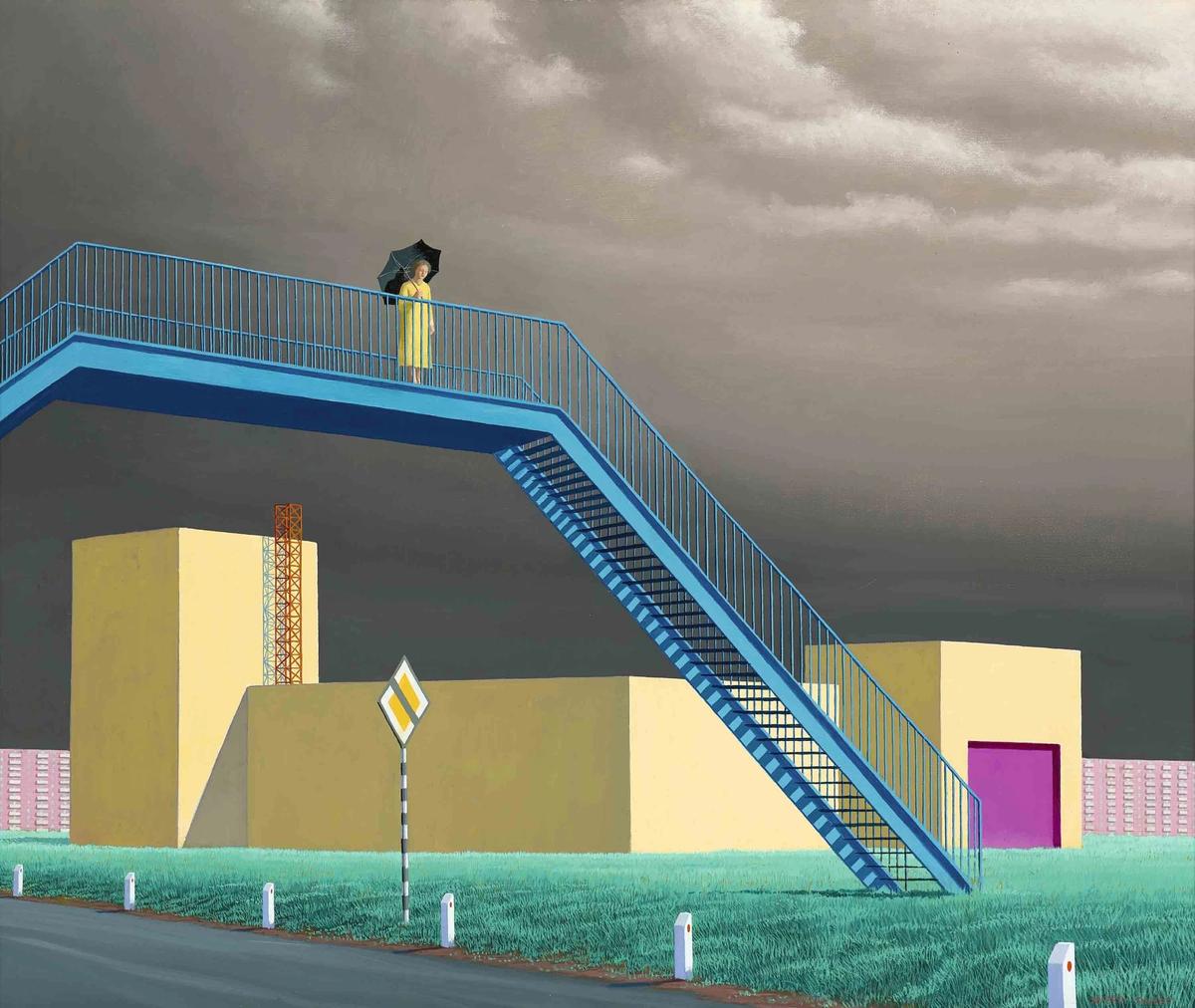

John Olsen's Dark Void (1976)

According to former National Gallery of Victoria (NGV) curator Robert Lindsay, the National Bank of Australasia, as it was known until it merged with the Commercial Banking Company of Sydney in 1983, “very much wanted to be a forward-thinking organisation” it acquired “contemporary art to say we are focused on the future.”

In 1982 the bank’s directors were so proud of their collection that they organised The Seventies, a major survey exhibition at the NGV.

By then, Lindsay recalls, the bank's staff had grown so fond of the art collection that they made the bank’s former director, Andrew Grimwade, promise the works would be returned.

But tastes change. And just as NAB’s directors once acquired contemporary art to present itself as forward-thinking, in 2022 it is possible the bank is forsaking its art collection in a bid to shake off the recent past.

In 2019 at the conclusion of the Australian Government’s Royal Commission into Banking, NAB was found to have overcharged 200,000 of its customers and ordered to pay compensation to the tune of Aus$2bn. It was a painful chapter for the bank that also saw two former directors fall on their swords after public admissions of wrongdoing by the bank.

Seventy-three high profile works from the National Australia Bank Art Collection go under the hammer from 7pm (AEST) on Tuesday 22 February at Deutscher and Hackett, and another 131 works will be auctioned from 6pm (AEST) on Wednesday, 23 February, at Leonard Joel.