The first moments of Phillips's 20th century and contemporary art evening sale yesterday were charged, with bids coming from every corner of the room and Phillips auctioneer Henry Highley swiftly shifting his attention from the phone banks and bidders in the room to those in New York and Hong Kong, then to the bids coming in from online every few seconds. That energy was almost palpable even when live streaming the sale, in part because there were, for the first time in 18 months, actual people bidding on art who were physically at 30 Berkeley Square.

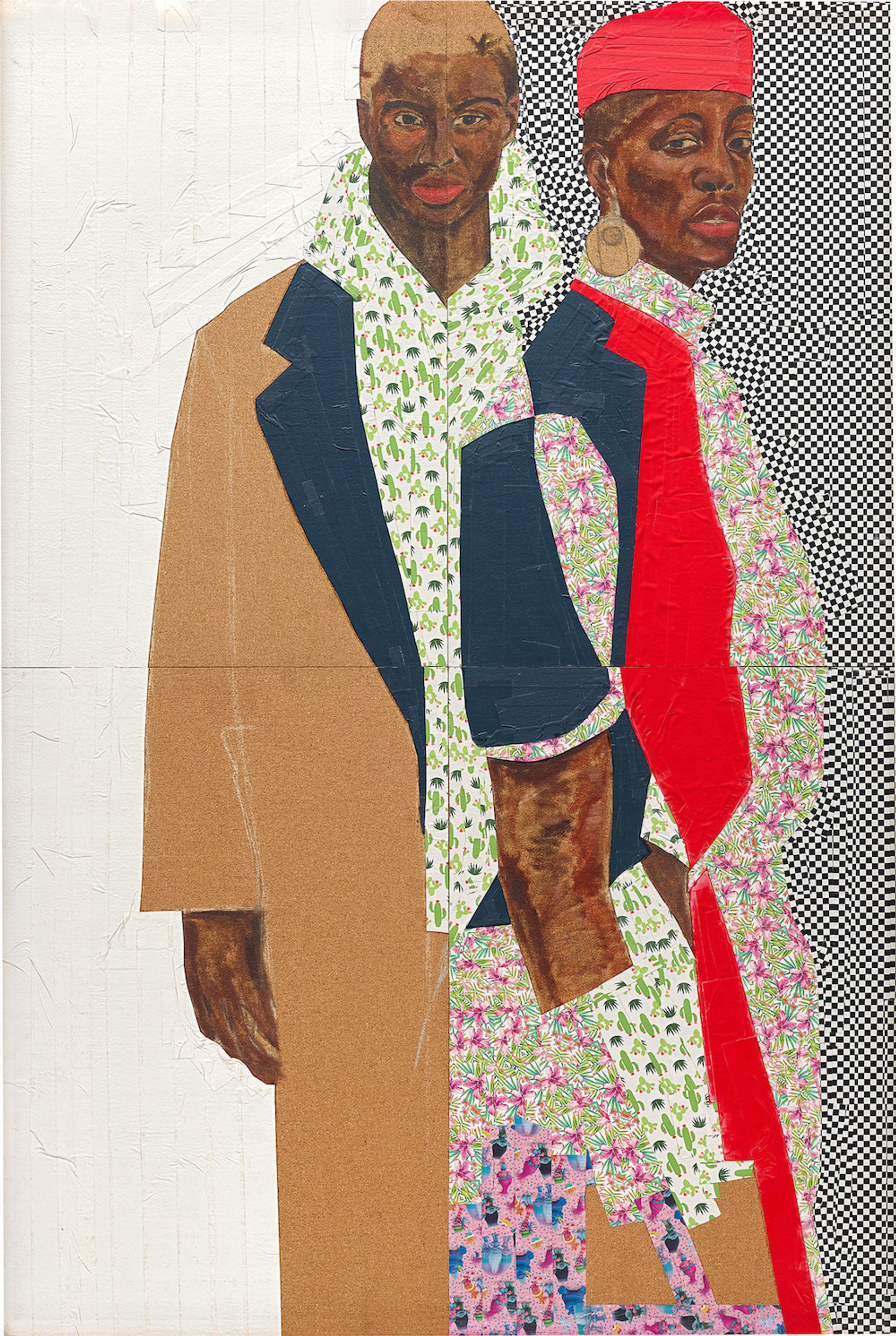

But the energy’s true source was the works up for sale. The first 30 minutes, during which the first nine lots were sold, easily outshone the remaining hour and half thanks to exorbitant bids. Asian bidders set the tone for the first quarter, though the first two lots went to a collector on the phones in London. Both works sold for over ten times the low estimate: Serge Attukwei Clottey’s Fashion icons (2020-21), which was estimated to sell for between £30,000-£40,000, hammered at £270,000 (£340,000 with fees) while Flora Yukhnovich’s Tondo (2016) brought in £420,000 (£529,200 with buyers premium) against a £40,000-£60,000 estimate.

Serge Attukwei Clottey, Fashion icons (2020–21). Image: courtesy of Phillips

The trend continued through the next few lots, each either marking an auction record for the artist or selling for around ten times the low estimate, often both. But these were young artists, some having only come to auction in the past few years. It is worth questioning whether such emerging artists belong in an evening sale and if such stratospheric prices can be sustained. Most still have work on the primary market in the £30,000-£60,000 range.

“There was a time when critical value and investment value were inseparable,” the art advisor Lisa Schiff told The Art Newspaper, “that isn’t the case anymore. The art market is becoming more of a fan-based economy. When you see prices like this for artists who are right out of the gate, the work is, more than anything else, a tradable commodity. Bids are based on who’s trending. You have to follow the conversation on Discord or Reddit and then speculate. The evening sales, which once were the most coveted and highly curated sales, have become more about what can sell for the highest number.”

There is another factor to consider when looking at the prices achieved for these relatively early career artists: cultural value. Phillips showed it was savvy to that fact by bringing in the East London rapper Kano to consult on both the day and evening sales. One of his recommendations for the evening sale, Serge Attukwei Clottey’s Fashion icons (2020-2021), was one of the record lots, hammering at almost 50 times the artist's previous auction record of $9,600 which was only set in 2021.

There was room for the more established artists in the sale to shine as well, though many of the remaining lots sold for below or just above the low estimate. Albert Oehlen, Sigmar Polke, Günther Förg all had major works in the sale. Förg's, Ohne Titel (untitled, 2008) did exceptionally well, hammering at £490,000 (£615,400 with feeds) against an estimate of £350,000-£450,000. The same buyer picked up a lovely Kusama, Silver Nets (EOKI) (2011) for £1.5m (£1.83 with fees) against a £1.2m-£1.5m estimate. Also worth a mention was Sigmar Polke’s wonderful, but uncomfortably titled, Negerplastik (negro sculpture, 1968), which hammered at £2.5m (£3m with fees), right in between its estimate of £2-£3m .

“We are thrilled with tonight’s result of over £25.2 million, which exceeded the pre-sale high estimate and sold 96% by value and 93% by lot,” Olivia Thornton, Phillips’ head of 20th-century and contemporary art, Europe, said. “The buoyant energy in London during Frieze Week is testament to our global collectors’ unwavering appetite for art and the strength of the market.” Energy indeed. During the sale seven artists records were set as well as two world auction records. Not bad considering 82% of the works had never been to auction.