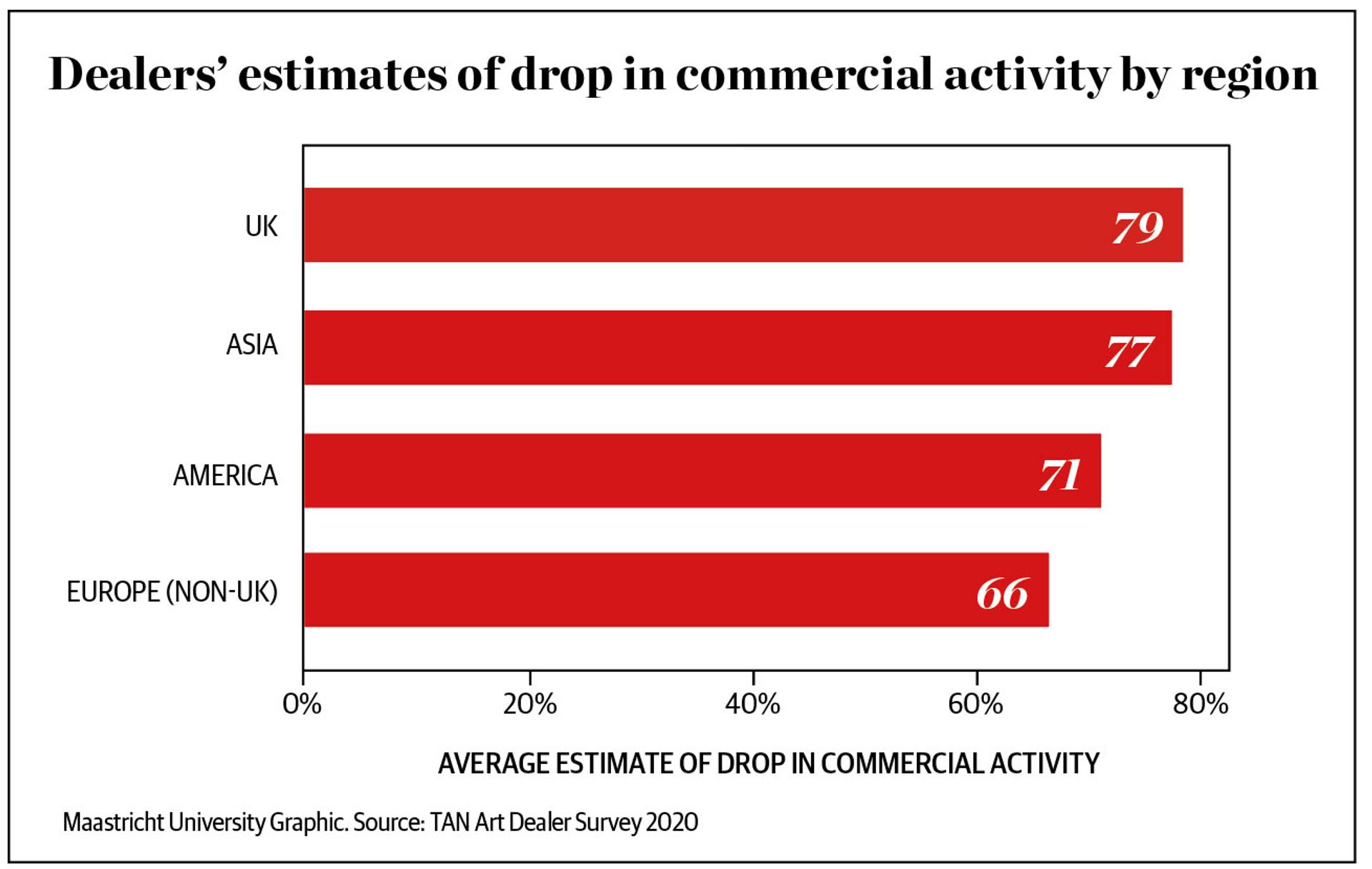

Galleries around the world are expecting to lose an average of 72% of their annual revenue due to the Covid-19 pandemic, according to a new survey by The Art Newspaper and the economist Rachel Pownall, a professor of finance at the University of Maastricht. However, dealers’ outlooks vary from region to region: those in the UK have the bleakest view, forecasting the highest drop in their financial activity (79%), followed by Asia (77%), North America (71%) and the rest of Europe (66%). The survey, carried out between 10 and 20 April when much of the world was under lockdown, tracked the impact of the pandemic on 236 international art and antiques dealers and galleries.

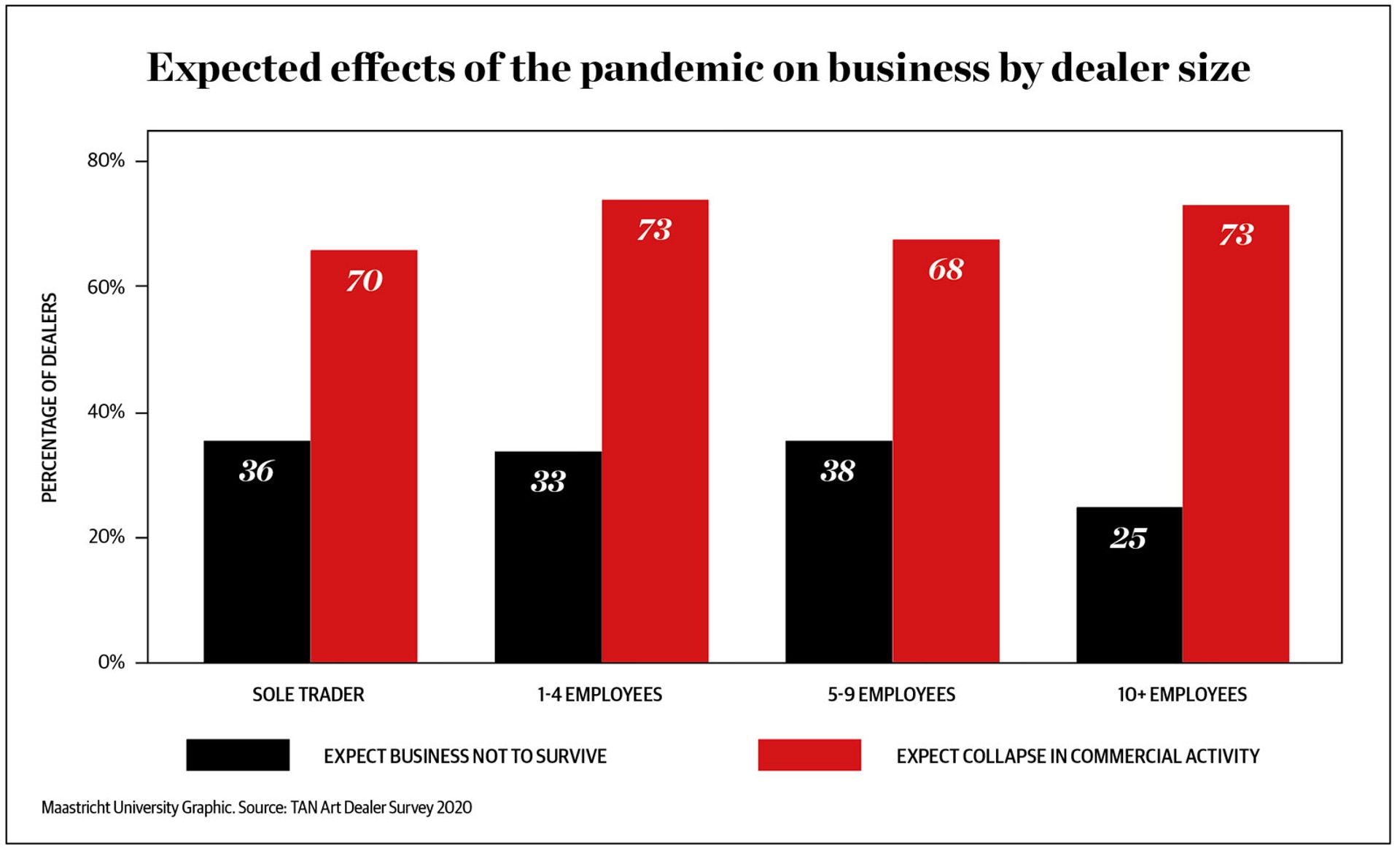

Around a third of galleries globally (33.9%) do not expect to survive the crisis, the survey also found. Emphasising the vulnerability of smaller businesses, dealerships with 5-9 employees reported the lowest likely chance of survival (62%), while larger galleries with more than ten employees were more optimistic, with three-quarters expecting to weather the crisis.

© The Art Newspaper/Maastricht University

Cash concerns

A drop in sales is, unsurprisingly, the primary worry among dealers during the pandemic; most of the surveyed galleries (82%) said they were “very concerned” about this. Liquidity is also a major source of anxiety, with 56% saying they were very concerned about a lack of cash (only 15% of dealers stated that the lack of cash is not a current concern). Inevitably, galleries with little or no financial cushion are also less likely to feel confident that their business will survive the pandemic.

34% of galleries believe they will not survive the crisis

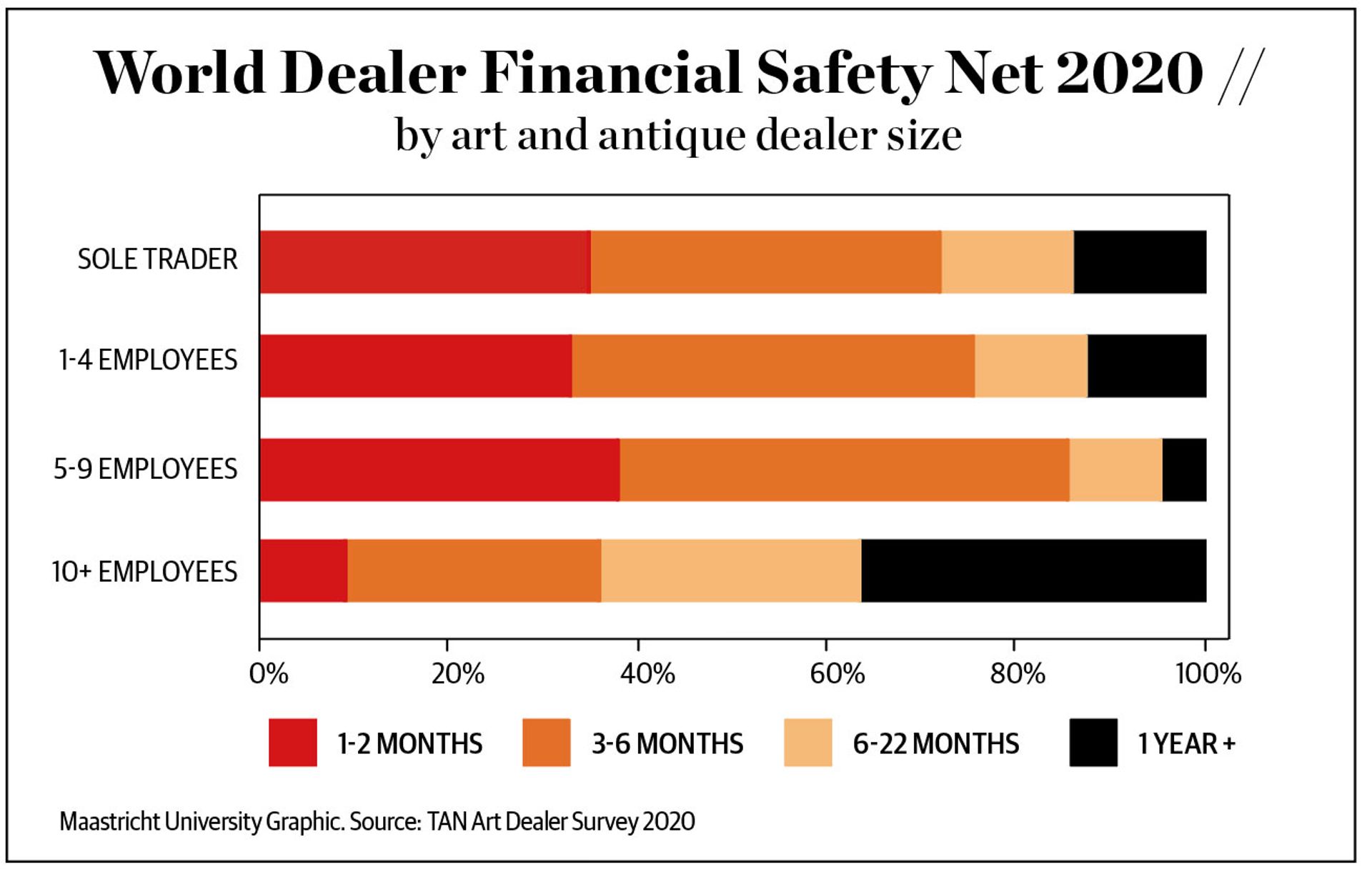

Larger galleries have a much bigger financial safety net, according to the survey, as reflected in the number of months they expect to be able to continue trading. On average, galleries have a financial buffer for just over two months, with dealers in North America and the UK struggling with cashflow issues more than the rest of Europe and Asia.

“It is devastating that we may see up to a third of galleries facing closure during this pandemic. Liquidity is key in surviving commercially. Business schools have long taught that ‘cash is king’ for business success, and short-term access to cash and availability of low interest loans are vital to ensure solvency. It is imperative that governments and financial markets provide cheap and plentiful access to additional financial support to all those who need it,” Rachel Pownall says.

The ability to protect employees is a further stress factor, as the lockdown continues to hit the arts industry with job losses. Among those who have recourse to a national furlough scheme, an average of 67% of the workforce had been furloughed. This applied to all of the staff for nearly half (46%) of the galleries. When greater accessibility to public loans was taken into account, however, most galleries predicted a smaller financial shortfall and a rise in their expectations of surviving the crisis.

Larger galleries also have a bigger financial safety net © The Art Newspaper/Maastricht University

Clearly, initiatives that specifically target small businesses and the self-employed are a vital lifeline for the arts sector. But governments around the world are reacting in different ways to the pandemic. Massive emergency aid programmes have been introduced by a number of European countries including Germany, which announced funding of up to €50bn in grants to companies and the self-employed. The UK furlough scheme, whereby the government contributes 80% of the wages of temporarily laid off staff, was supplemented by an income support scheme for the self-employed. And US President Donald Trump’s $2trn economic relief package also includes a fund of more than $370bn specifically for small businesses.

However, for many, government assistance has not gone far enough. “Not one of the programs has helped my business,” says a New York-based dealer who responded to our survey. “Sole proprietors who already work from home since 2013 because of the previous recession and do not take salaries, due to the fluctuations of income, cannot qualify for government programs...yet we pay income tax; franchise and excise tax on the inventory; as well as city and county property taxes on the home where we work from.” In the UK, new businesses and people who have been self-employed for less than a year are also falling through the cracks. “Having only started [my business] in May 2019 I don’t get the self-employed grant even though I was profiting around £1,200 a month. I only get the £10,000 business rate relief grant, which is not going to cover lost sales and expenses in one of the busiest times of the year. I don’t think I will carry on as the risk is too great.”

UK dealers predict the highest drop in their commerical activity © The Art Newspaper/Maastricht University

When asked what kind of government support would be helpful to their business, many suggested tax relief and help with salaries, particularly in the US. “But this won’t ever happen”, said one American respondent. More commissions from the public sector was also offered as a solution.

“Collaboration and fair play featured highly in the galleries’ responses as to how they can be helped during the pandemic, from art fairs reimbursing paid fees, to online platforms promoting sales at a reasonable price, to tax and VAT exemptions—across the art world, this will help free up cash and help galleries survive the Covid-19 crisis,” Pownall says. “The chain of players involved, from landlords to auction houses to governments, highlights the broader economic ramifications that the art world has on our economy, while the lockdown highlights the societal impact of a world devoid of arts and culture. The silver lining may be that this shines a light on the importance of the arts and may encourage improved financing of the arts in future.”

Rent relief

According to the survey, galleries are also struggling to pay hefty rents for premises that they cannot even enter, let alone trade from—two-thirds of galleries report they are either “very concerned” or “concerned” about this. For many smaller galleries it is make-or-break time; they say that if they do not get some form of rent relief now—be it a rent reduction, hiatus or total waiver—they will not survive the shutdown.

Galleries whose rents account for a higher percentage of their monthly outgoings are most vulnerable, and there are big variations depending on location: in New York city, the average dealer’s rent is almost 40% of monthly outgoings, compared with 35% in London and 27.5% in Paris, for example.

40% of monthly outgoings are spent on rent in New York city

Some countries and cities have developed initiatives which may mitigate the rent problem. In New York, Governor Andrew Cuomo enacted a 90-day mortgage freeze for property owners due to Covid-19-related financial losses; however, a similar reprieve for renters has not yet been granted. The governor also placed a moratorium on evictions for three months, but the measure does not prevent building owners from filing eviction notices in the meantime, meaning that tenants with backlogged non-payments would face steep costs and possible eviction once it is lifted.

In the UK, the wide-ranging Coronavirus Act 2020 includes a provision that prevents landlords from terminating commercial tenancies by forfeiture (that is, by instructing a bailiff to change the locks or by issuing forfeiture proceedings in court) or eviction for non-payment of rent until 30 June. But galleries could still face problems with their landlords because the act does not obstruct other enforcement options available to landlords.

The results of our survey echo the findings of another recent study, conducted by the French trade organisation Comité Professionnel des Galeries d’Art. It found that a third of French art galleries fear they may be forced to shut before the end of 2020. The report pointed out that a previous survey on the impact of the art market crash in 1990 showed that recovery only began in 1995. In the meantime, 46% of galleries in France had disappeared.