Asset tokenisation. Fractional ownership. Hedging. Derivatives. The terms and processes of the money world are increasingly washing into the art market, as financiers and tech wizards seek ways of cashing in on the enormous profits that, they say, can be generated by art.

Over the past year or so, a growing number of new investment platforms are touting “fractional ownership”, or tokenisation of art, most using blockchain technology, to allow the small investor to own a tiny part of a work of art. The idea is that dividing ownership of an asset (in this case a work of art) and selling it via tokens, leads to greater liquidity in the marketplace and enables the small investor to share in price rises.

The pitches from these start-ups all emphasise what they say is a freeing up of the art world. “Opening the doors to top-tier, A-class art investment” promises Masterworks. Maecenas will “democratise access to fine art”. Look Lateral “makes the market more transparent, accessible and liquid”. “Everyone can be part of the game” proclaims Feral Horses.

The approaches vary. Feral Horses sells shares in art they select themselves. Masterworks plans to buy works of art at auction and then sell shares in them. On resale, the investors split any profits.

Most of the start-ups issue their own cryptocurrencies, which is also their way of funding their businesses through ICOs (Initial Coin Offerings). Cryptocurrencies are how investors pay for the shares they buy in works of art; the transactions are then recorded on the blockchain.

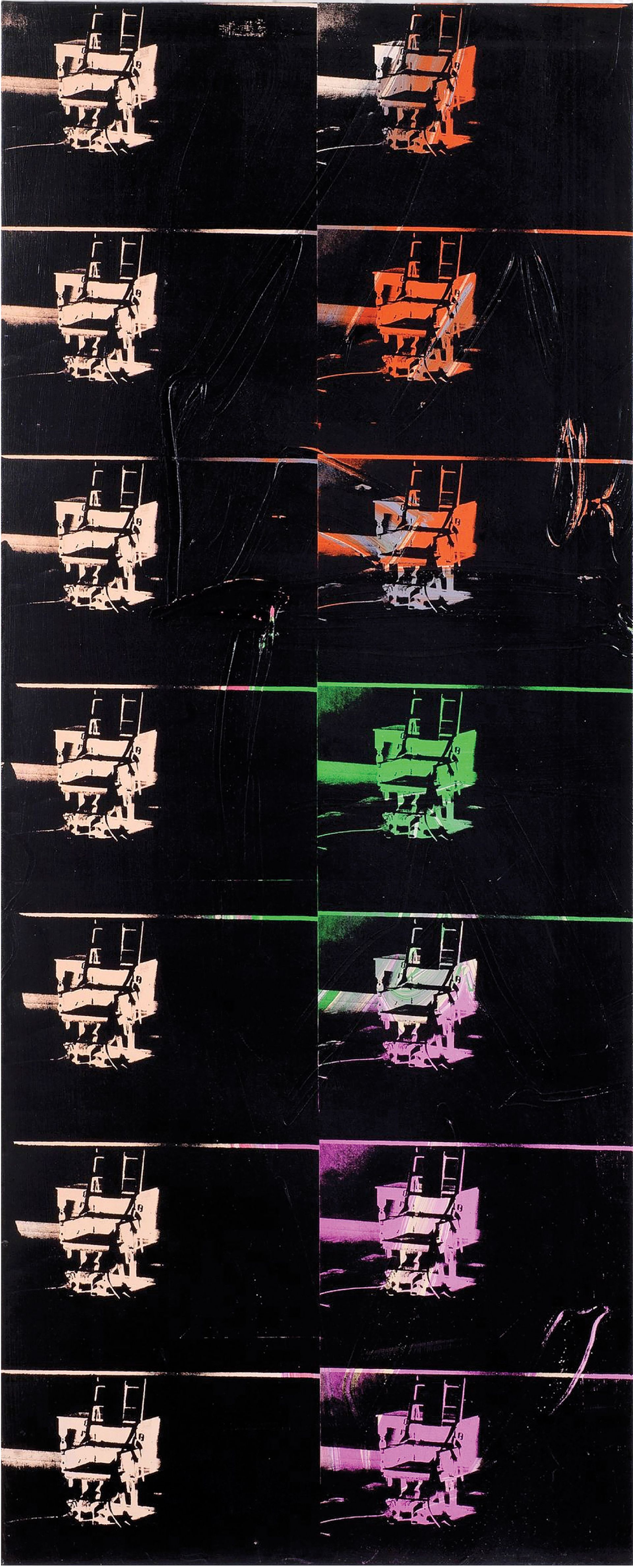

Andy Warhol’s 14 Small Electric Chairs (1980) Courtesy of Maecenas

But the most disruptive aspect of these businesses is the creation of exchanges on which investors can trade their ‘tokens’, which represent their shares in a work of art. These tokens, a form of derivative, will in theory increase in value as the underlying asset, the work of art, increases in value. So, it is not necessary to sell the work of art to make money, just to trade in the tokens themselves. But of course these can go down as well as up, just like the underlying asset…

Maecenas carried out its first “tokenisation” in September, selling a 31.5% stake in Andy Warhol’s 14 Small Electric Chairs (1980), for $1.7m. The vendor, the Cork Street-based Dadiani Syndicate, was selling 49% of the work at a total valuation of $5.6m—possibly an optimistic figure, since it failed to sell at Bonhams in February 2016 at an estimate of £4m. Payment was possible in Bitcoin, Ethereum or ART, Maecenas’s own currency.

I asked Maecenas’s chief executive officer Marcelo Garcia Casil if the company would receive the full amount, since cryptocurrencies were dropping in value at that time. “Yes, we hedged that risk,” he answered, “And the transaction is settled in dollars.”

One characteristic of this new disruption is that the players are from the finance world, not the art field. On a recent episode of the TV programme Dragons’ Den, the Feral Horses team, seeking a modest £50,000, were roundly demolished by the dragons (things got fairly heated at one point), partly because they were entering a sector in which they have no experience.

Previous attempts to sell shares in art have mainly failed, notably the Luxembourg-based SplitArt, which was liquidated in 2012. But, say the new generation of hopefuls, this was in advance of its time and things are different today. We shall see.

• Georgina Adam is The Art Newspaper’s art market editor-at-large and the author of Dark Side of the Boom: the Excesses of the Art Market in the 21st Century and Big Bucks: the Explosion of the Art Market in the 21st Century (both published by Lund Humphries)