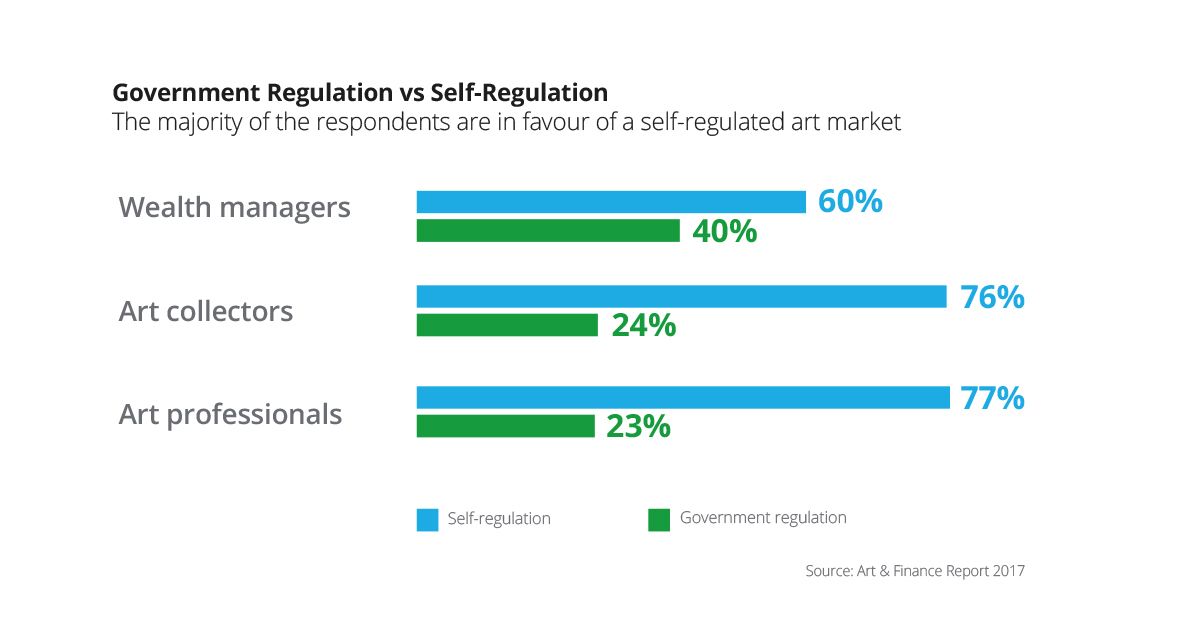

The fifth Deloitte Art & Finance Report, released today at the firm’s conference in Milan, forecasts that the ultra rich will spend $2.7 trillion on art by 2026. It also raises questions over trust and transparency in the art market, as 48% of collectors say lack of standards is a major concern, yet found that collectors, wealth managers and art professionals were overwhelmingly in favour of self-regulation over government intervention.

The authors, Adriano Picinati di Torcello, the director at Deloitte Luxembourg and global art and finance coordinator, and Anders Petterson, the managing director of the research firm ArtTactic, observe an "increasing convergence between collectors, art professionals, and wealth managers on the role of art in a wealth service offering, as well as a convergence of different stakeholder initiatives when it comes to improving art market transparency.”

Alongside a global market overview, showing strong growth for African art and a slowdown in Southeast Asia, the report’s core offering is the Art & Wealth Management Survey. This year it queried 69 private banks (including 27 family offices), as well as 155 art professionals and 107 international collectors. Additional data came from auction houses, art funds, and art trusts, though in many case this is limited to publicly available information.

Not only is art increasingly viewed as an investment, the survey found, it is also considered a “lifestyle” product: 63% of collectors said that social value was their primary reason for buying art. However, unlike museum patrons of yore, just 5% intend to donate their collections to institution, while 67% will pass to their heirs.

Deloitte

The market's handshake-agreement economy still poses a problem as art is increasingly seen as an asset class, putting off banks and lenders from entering the market. Seventy-five percent of wealth managers decried the art market’s lack of transparency, and 65% said the unregulated nature of the market “remains a key hurdle”. Although new money-laundering rules coming into force around the world may force more disclosure, issues around risk, liquidity, and valuation remain.

Undisclosed conflicts of interest in art transactions are of concern to 65% of wealth managers and 69% of art professionals. Furthermore, questions of authenticity, provenance, and attribution vex both sides, with 83% of wealth managers and 81% of art professionals deeming these as the greatest risks to the art market.

The report identifies several trends. One is a convergence of the auction (secondary) and dealer (primary) markets in the online sphere, as platforms like Invaluable and Artsy diversify their income streams to stay competitive. In parallel, the increasingly sophisticated analytics available to parse the growing pool of data is “is an important development and could contribute toward improving transparency, valuation accuracy, and risk management of art-related wealth”, says the report.

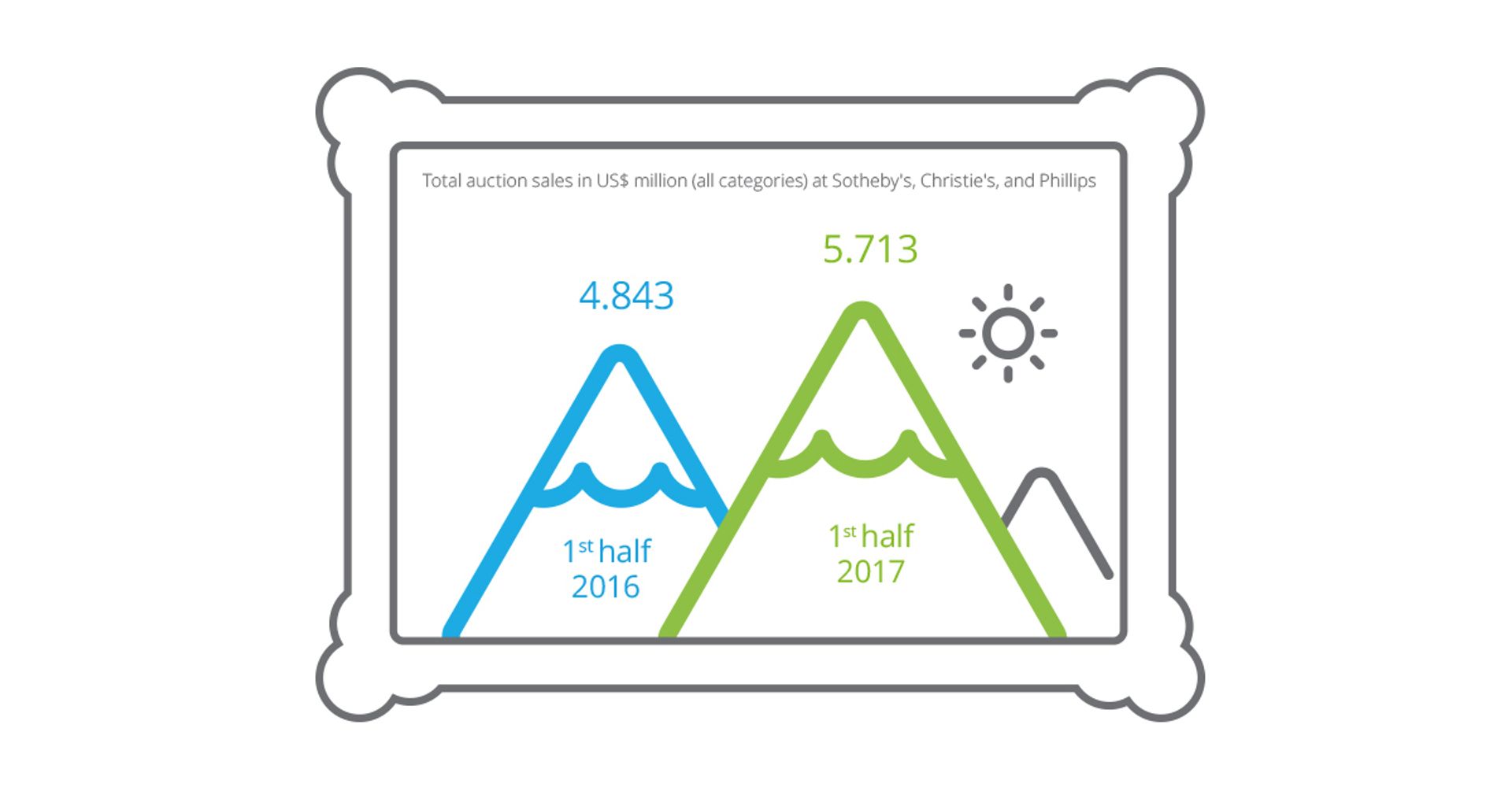

Another section points to an apparent paradox of the 2017 art market. Although the private market is healthy and sales at Christie’s, Sotheby’s and Phillips have picked up by $1.08 billion, compared with the same time last year, market confidence (as measured by ArtTactic’s “confidence indicator”) declined 13.4% during the first half of the year. While that skittishness was surely the product of many factors–including geopolitical unrest and the auction houses’ renewed reliance on financial guarantees to win prime material–the report’s authors write, “the bigger question is whether we are starting to experience a shift in the way that the global art market behaves”, and ask: “Could art market volatility be set to increase as art buyers become more investment-oriented and increasingly amenable to short-term investment horizons?”

The answer may depend on the attitude of the world’s ultra rich population–those with a net worth of more than $30m—whose ranks are expected to swell by 43% in the next decade.