The European Fine Art Fair (TEFAF) in Maastricht today (29 June) released its Art Market Report: Online Focus, a supplement to the annual Art Market Report released in March.

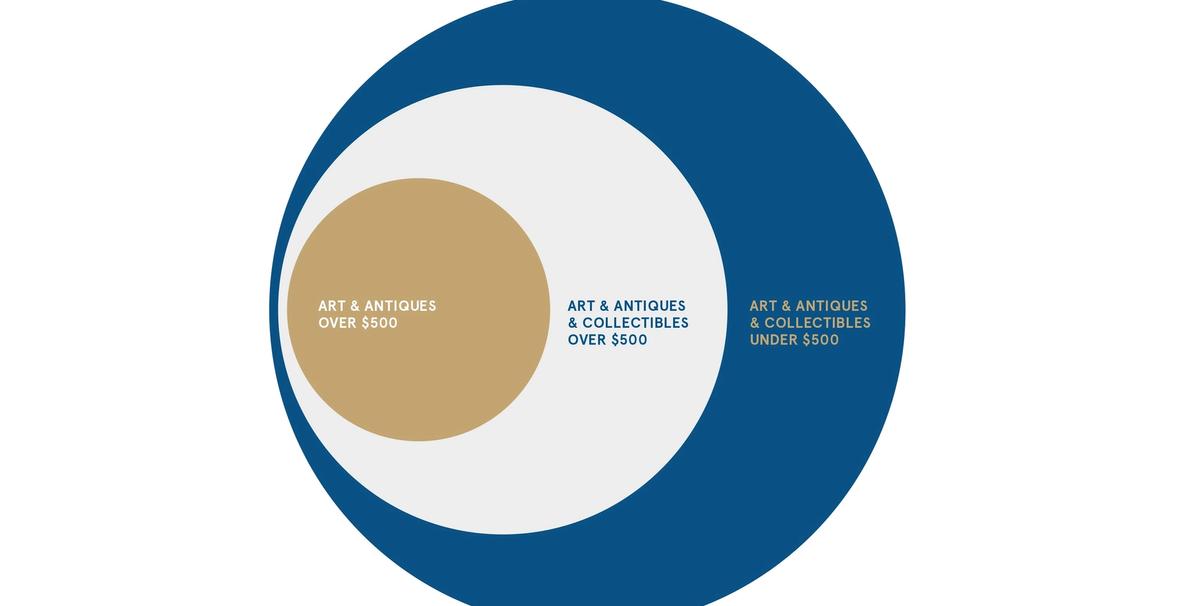

Her findings mostly confirm the most noticeable trends, namely that large auctioneers who have embraced their digital platforms—Heritage, Christie’s, and Sotheby’s—claim the largest share of an estimated $3.1b market (which the Hiscox Online Art Sales Report puts it at $3.75b; Art Basel’s The Art Market 2017 report, $4.9b). Pownall’s report further qualifies that of the $3.1b, fine art and antiques account for only $2.6b (the rest being other collectibles, automobiles, wine, etc).

The data is derived from “profiles of 100 companies”, 39 of which responded to a survey; a survey of more than 8,000 dealers, with a response rate of 8%; and a sample of data from 3,349 auction houses who list on Tefaf partner Invaluable. In her surveys, Pownall defined art as “objects including fine art, antiques, decorative art, collectibles, haute jewellery, photography, and design”, but the queried companies include e-tailers like Etsy and RubyLane alongside art-specific businesses.

Per the data, online transactions account for 8% of all art auctions, and the most popular format is online bidding during live auctions, rather than online-only timed sales or fixed-price options. Christie’s led the field in 2016, with online sales (both live and timed) of $217m, while Phillips had the highest average price per lot sold online, with 70% of prices exceeding $10,000. On the primary side, dealers made $1b in online sales last year, and although the growth reported by dealers with an online presence is notable—19%—some 20% say that their e-commerce activities operated at a loss in 2016. Nearly one fifth of dealers responding have no intention to transact online.

The report breaks down the dizzying array of art purveyors into direct, indirect, and redirected sales models, with fixed or auction pricing. Pownall predicts further hybridization across sales channels—as did Artsy venturing into auctions, for example, or Invaluable offering galleries a buy-now platform—but also increasing specialisation within niches. “Currently there is no clear market player with overall dominance”, she writes.

Behind any online sale, a strong brand is crucial. Respondents see digital tools and platforms offered by third parties not as a replacement for but a complement to an existing sales operation.

The small number of transactions at the top end of the market is often blamed on a lack of trust and transparency. While virtual currencies like Bitcoin initially looked promising to secure and track transactions, it is the blockchain technology that runs them that may find an eventual application in the art market for authentications and validations. According to the report, three out of four auction houses and one in five galleries plan to offer blockchain technology within five years; just 3% do at present.

For now, Pownall writes, “The limited size of the art market means that current systems are sufficient and a digital ledger is unnecessary”. That could change, however, if the market were to expand—either in size or speed of transactions.