In a highly competitive market, there are signs that private banks are getting more creative with their sponsorship of art fairs. At November’s edition of Artissima, Italy’s leading contemporary art fair, the sponsor UniCredit found a new way to get onto clients’ radars: free art advice for all.

“We’re branching out and helping newcomers to navigate the contemporary art world,” says Domenico Filipponi, the head of art advisory at UniCredit Private Banking. “Of course, this is an operation that gives us great visibility,” he says, adding that the advice is free and that the bank gets no commission on possible purchases. “It sends out a strong signal to our clients that our advice is independent,” Filipponi says.

Banks and art fairs have been bedfellows for some time. UBS and Art Basel have been partners for 22 years, and Deutsche Bank and Frieze for 12 years. Several other private banks around the world are also in on the game: Royal Bank of Canada (RBC) at Masterpiece London, Credit Suisse at Moscow’s Cosmoscow and J.P. Morgan at the Seattle Art Fair. The banks ABN AMRO and ING support The European Fine Art Fair (Tefaf) in Maastricht (the event’s main sponsor is the insurance firm Axa Art).

The pairing is logical: it provides banks with a sought-after cultural backbone that can complement their corporate art collections, while simultaneously positioning them within reach of new and potentially lucrative clients.

Although many banks offer art consultancy, none appears to be quite as open as Unicredit during the fairs. Deutsche Bank gives existing clients tours of Frieze using either external guides or its own curators, who can make introductions to dealers and give background information but are barred from advising directly on purchases. UBS also offers bespoke tours to clients.

Other sponsors are growing more adventurous. At Masterpiece London in June, RBC chose a different work from the fair each day to highlight to clients in its VIP lounge. “Gone are the days when sponsors gave you money and just asked for their name to be on the invitations,” says Nazy Vassegh, the fair’s chief executive. It is a shift that Marc Spiegler, the director of Art Basel, has observed in other art-fair sponsors. “In the old days, they were happy just to have a logo and a lounge, and now they want to do something in the art world,” he told the Talking Galleries conference in November, citing the BMW Art Journey prize and Davidoff’s artist residencies.

Are these additional services stepping on independent advisers’ turf? “Art advisers have their loyal clients, and the service they offer is quite different,” says Arianne Levene Piper, an independent art adviser who previously worked at UBS. “They will generally spend more one-on-one time with them. A bank might have thousands of private clients, but it might not have hundreds of advisers,” she says.

All the banks’ representatives are quick to say that they do not offer direct art investment advice, nor do they do any direct business during the fairs. The connections between art fairs and their banking sponsors were tarnished in 2008 after a Florida jury indicted the head of UBS’s wealth management business for helping Americans hide money in secret accounts, having sought out clients at Art Basel in Miami Beach. (A deal was subsequently struck between the US Internal Revenue Service and the Swiss government; the legal action was dropped and UBS’s sponsorship was unaffected.)

For the banks, the core element is still entertainment, despite the more creative ideas. “Spending hours at an art fair together, rather than a 45-minute office meeting, can forge a closer connection. Private banking is a very personal business,” Levene Piper says.

“Never underestimate the importance of the lavish VIP lounges; they make clients feel very special,” says the fair organiser Tim Etchells. At this year’s Art Basel in Miami Beach (3-6 December), UBS’s lounge will include a “living sky garden suspended from the ceiling”, as well as an installation of 30 works in its collection, according to Hubertus Kuelps, the bank’s head of communications and branding. The cost of creating the VIP areas is on top of the bank’s sponsorship package, which can run to seven figures.

Banks are not always the best partners, and, like all sponsors, they can come and go. Citi Private Bank, which sponsored Art13, has not renewed its three-year arrangement. Banks are also subject to events outside the art fair’s control. In 2008, Lehman Brothers was the first lead sponsor of ArtHK (now Art Basel in Hong Kong), four months before declaring bankruptcy.

When it works, everyone is happy. “It’s not just about a fair getting money. Having a bank as a principal sponsor gives an art fair validity in financial circles and gives the bank access to a cultural community,” Vassegh says.

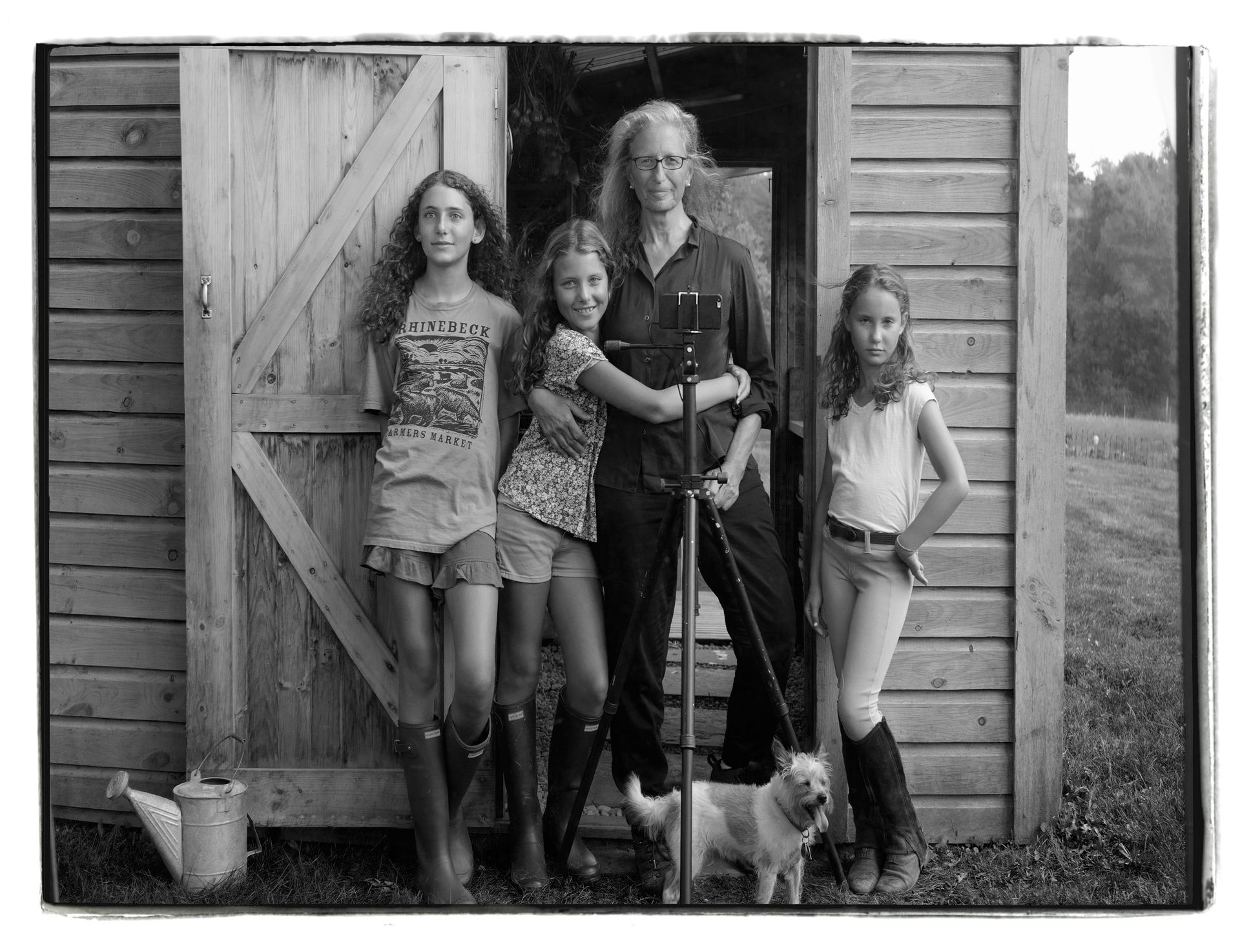

UBS puts Leibovitz’s past aside Banks are increasingly offering loans against art to their high-net-worth clients. This strategy has not prevented UBS from supporting a new body of work by the photographer Annie Leibovitz, who famously defaulted on a $24m art loan in 2009. The bank, which was not involved in the 2009 loan, seems happy to overlook the photographer’s previous financial problems. “No one’s asking her to be an expert at what we’re an expert at,” Hubertus Kuelps, UBS’s head of communications and branding, told Spear’s magazine in October. (UBS organises art loans through the specialist firm Emigrant Bank.)

The bank is backing the second phase of a project that Leibovitz began in 1999 with Susan Sontag. Women: New Portraits is due to open in the Wapping Hydraulic Power Station in London (16 January-7 February 2016) before touring nine other cities around the world. The full list of sitters has yet to be revealed, but they will include the tennis champion sisters Serena and Venus Williams, and Leibovitz with her three daughters.

“Family photos are very important to me, not least as a single mum with three young kids,” Leibovitz says. The photographs will form part of UBS’s corporate collection. M.G.

• For more information, see ubs.com/annieleibovitz